Home Of Fair Facts & Tips

Spotting Property Scam Red Flags

Learn how to spot property settlement scam red flags, use Scamwatch Australia tools and protect your home deposit from fraud.

Property settlement scams are targeting Australian buyers and sellers at the worst possible moment, right as deposits and settlement funds are due. This article explains how these scams work, why they are growing, and the warning signs to look for in emails and payment requests. You will see a simple example of how a $500,000 purchase can be put at risk by a single fake message. You will also get clear steps on what to do if you think you have been scammed, including who to call first and how to chase help. The goal is to help you move through your property journey with confidence while staying one step ahead of scammers.

Key takeaways

- Property settlement scams target big transfers like deposits and settlement funds using fake emails and bank details.

- Simple checks, like calling your conveyancer on a known number, can stop most scams before money leaves your account.

- If you think you have paid a scammer, contact your bank immediately and then report it to the official scam channels.

- Using secure apps, scamwatch tools and clear processes turns a stressful scam risk into a manageable safety checklist.

Related reading: Buying your first home safely

- Your Beginners Guide to Buying Property

- Ultimate House Hunting Guide: Find Your Dream Home

- Hidden Costs of Buying a Home: What You Need to Know

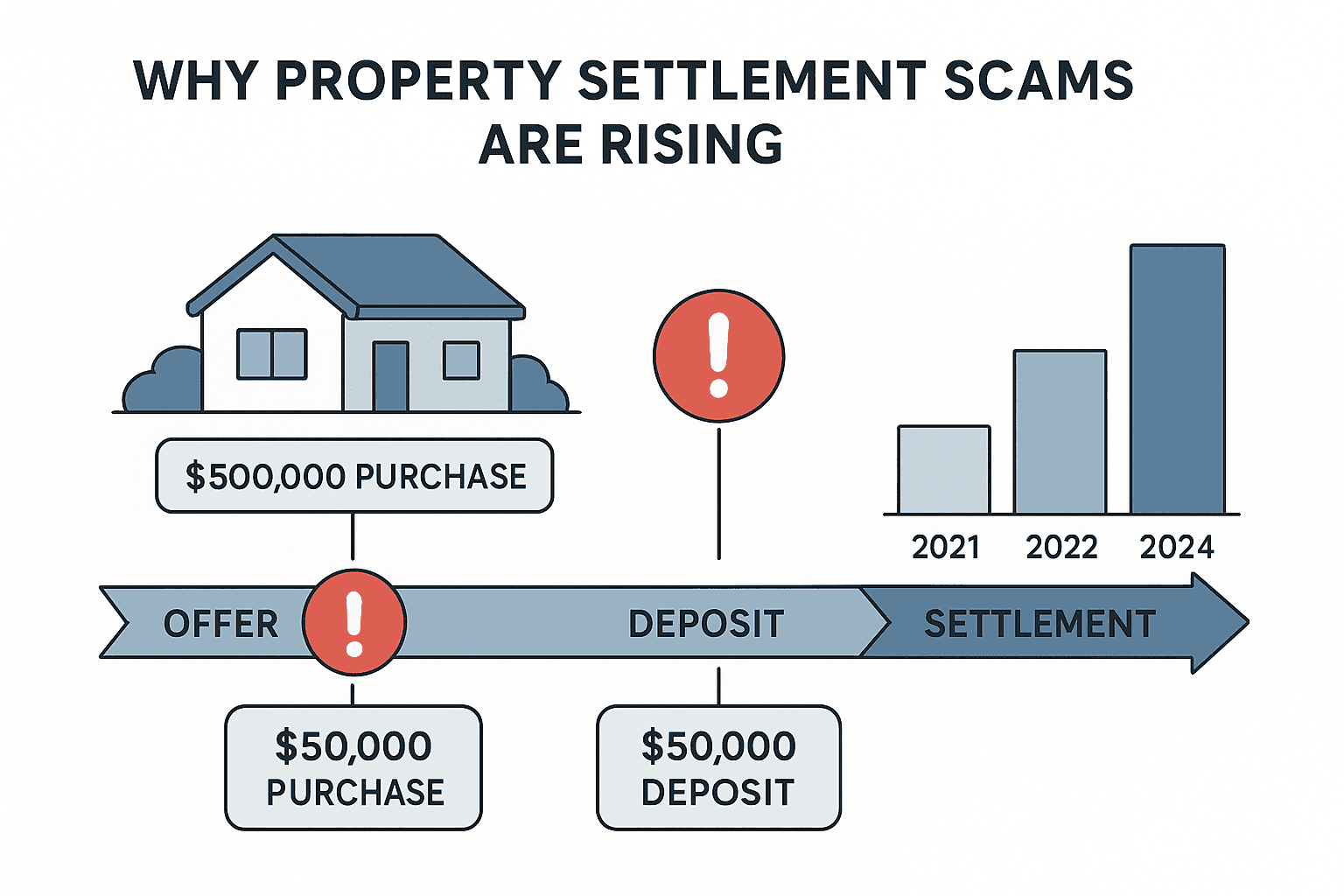

Why property settlement scams are rising

Property settlement scams sit in a nasty sweet spot for cybercriminals. There is usually a large amount of money in play, strict timeframes, and a long chain of emails between buyers, sellers, agents and conveyancers. Recent research from PEXA found that 97 percent of Australians who bought recently or plan to buy soon missed dangerous scam markers in fake settlement emails, even though most felt confident spotting scams.

These property scams are a specific kind of scam fraud where criminals pretend to be someone you trust, such as your conveyancer or real estate agent. One PEXA white paper notes that property settlement scams have become one of the most financially devastating forms of cybercrime in Australia.* Criminals gain access to or copy email accounts, quietly watch the transaction, then jump in at the critical moment with “updated” bank details. Because everything looks familiar, many buyers do not pause to question the change.

The money at stake is huge. Cases in the media include a Western Australian buyer who lost $732,000 and a Sydney couple who lost $970,000 after sending settlement funds to a fake account. Australians lost more than $16.2 million to payment redirection scams in 2023, with real estate transactions among the top targets, and “buying and selling” scams leading to $43.2 million in reported losses in 2024. For many families this is a life changing setback, not a small bump.

Imagine you are buying a $500,000 unit in Melbourne with a 10 percent deposit. You need to send $50,000 for the deposit and later the balance of the settlement funds. A week before settlement you receive an email that looks like it is from your conveyancer, saying the trust account has moved and giving new bank details. The email includes a logo, a familiar sign-off and a friendly tone. If you do not question it and send the $50,000 to the new account, you may only discover the problem when your real conveyancer calls asking where the money is. At that point the scammers may have already withdrawn the funds.

Across scams Australia wide, regulators like the National Anti-Scam Centre and services promoted by Scamwatch Australia are highlighting that property scams are no longer rare edge cases. They are part of a broader pattern of bank scams, where fake instructions are used to redirect large transfers. The good news is that the same habits promoted by accc scamwatch, such as double checking payment details and using secure communication channels, work very well in property settlements too.

Checklist: Understand the risk landscape

- Recognise that property settlement scams target high value transfers, not just small online purchases.

- Treat every email about bank details as high risk until you verify it through a separate channel.

- Learn the common red flags such as last minute bank detail changes and strange email addresses.

- Save trusted phone numbers for your agent, conveyancer and bank before the transaction heats up.

What this means for Buyers

- Plan for scam risk from day one of your property search instead of waiting until settlement week.

- Agree with your conveyancer and agent up front on how payment details will be shared and confirmed.

- Use official resources like the scamwatch website and australian scam watch alerts to stay informed about new tricks.

What this means for Sellers

- Remember that scammers can target your incoming proceeds as well as the buyer’s outgoing funds.

- Only share your bank details through secure channels approved by your conveyancer or platform.

- Warn buyers you will not change bank details by email so they know to treat such emails as suspicious.

Quick Q&A

Q: Why are property settlement scams so attractive to criminals compared with other investment scams?

A: Property settlements combine big amounts of money, strict deadlines and heavy use of email, so a single fake message can net more than many smaller investment scams.

Q: Is there a simple scam watcher or scam check Australia tool I can use before paying my deposit?

A: There is no magic button, but you can use guidance from accc scamwatch, your bank’s security alerts and your own clear process of always confirming any bank detail changes by phone.

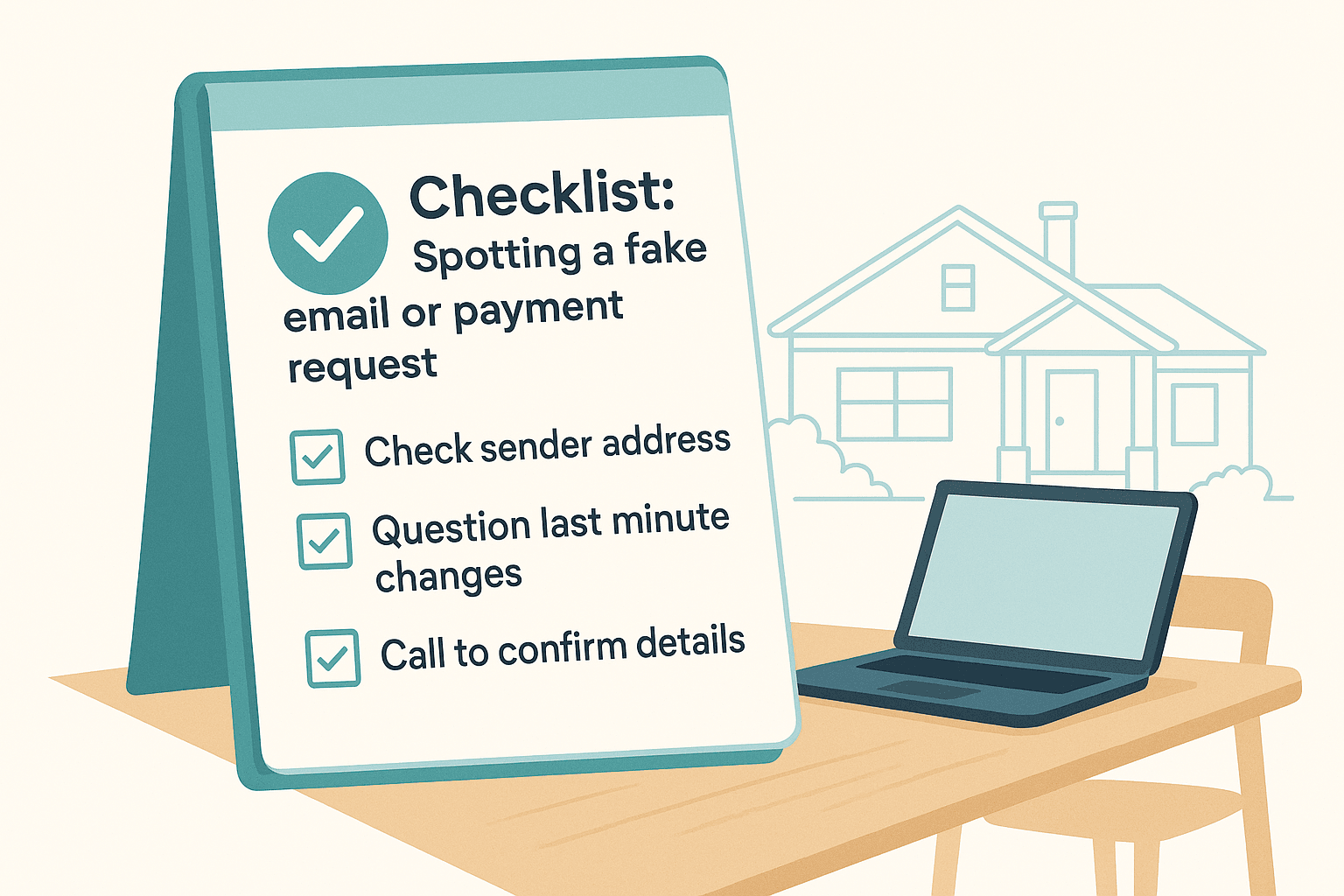

How to spot a fake email or bank account

Most property settlement scams rely on business email compromise, which is when criminals either break into or copy an email account used in the transaction. The fake messages look legitimate, but the small details are wrong. One PEXA expert explains that criminals know they do not need to compromise systems, they just need to compromise trust.* Scammers often wait until the last moment, then send a message saying bank details have changed and urging you to pay straight away.

There are five classic warning signs. First, a last minute change to account details just before money is due. Second, an urgent or pushy tone telling you to pay immediately to avoid penalties. Third, an email address that looks almost right but has extra letters or subtle spelling errors. Fourth, a request to reply to a different email or click a link to see “new” bank information. Fifth, a Confirmation of Payee warning from your bank saying the account name does not match the number. The Scam Awareness White Paper calls out all these signs and stresses the need to stop and verify before paying.

Consider a couple buying a $750,000 house in Brisbane with a 5 percent deposit. They have already paid a $37,500 deposit to the agent and are now getting ready to send $712,500 in settlement funds. A fake email arrives saying the conveyancer’s trust account is being audited and deposits must go to a temporary account instead. The email includes a familiar logo and a near perfect signature block. The only giveaways are a slightly altered domain name and a strong sense of urgency. If the couple ignore those clues and pay, the funds may land in a bank account fake that is drained within hours.

To protect yourself, treat email as a notice board, not as a place to approve payments. When an email includes bank details, do not copy and paste straight into your banking app. Instead, call your agent or conveyancer on a number you already saved, not the one in the email. Ask them to read the BSB and account number out loud and match it against the details you have. You can also ask your bank about tools it uses to fight bank scams, such as extra checks on new payees and prompts to confirm payee details.

Beyond the property transaction, learning how to spot a scammer generally will help you with other scams Australia wide. Before acting on any request involving money, ask yourself three questions: Was I expecting this message? Is the sender definitely who they say they are? Have any details, such as bank numbers or web addresses, changed from last time? If anything feels off, pause and treat the message as a possible mortgage company fraud attempt until you have checked it properly.

Checklist: Spotting a fake email or payment request

- Check the sender’s full email address for typos, extra letters or swapped characters.

- Be suspicious of last minute changes to bank details or new accounts you have never heard of.

- Watch for urgent language that pressures you to act immediately or in secret.

- Never rely only on email to confirm bank details, always confirm by phone on a known number.

What this means for Buyers

- Save your conveyancer’s and agent’s numbers in your phone so you can confirm details quickly.

- Ask your bank about any alerts or Confirmation of Payee prompts and pay attention to them.

- Use official scamwatch Australia and australian scam watch information as your personal scam watcher guide.

What this means for Current borrowers

- If you are refinancing, treat any email about new loan accounts, direct debit changes or cashback offers with extra care.

- Call your lender using the number on their website, not the number in a random email or SMS.

- Keep a simple log of any changes you agree to, such as new account numbers, so you can spot fake changes later.

Quick Q&A

Q: How can I quickly check if payment details are real before I send money?

A: Use a two step check. First, call your conveyancer or bank on a saved number and have them confirm the BSB and account number. Second, pay close attention to any Confirmation of Payee warnings, as they are designed to flag bank account fake risks.

Q: Are these emails linked to other bank scams or just property transactions?

A: The tactics are similar to other bank scams, but here the focus is on large one off transfers at settlement. Scammers reuse the same approach in other areas, such as fake investment scams or tax refunds, so the habits you build for property will help you elsewhere too.

Related reading: Smooth settlement and valuations

- Mastering Settlement Day: Your Ultimate Guide to a Smooth Property Handover

- Stamp Duty Explained: A Property Buyer's Roadmap

- How to Get Free Property Valuation for Owners and Buyers

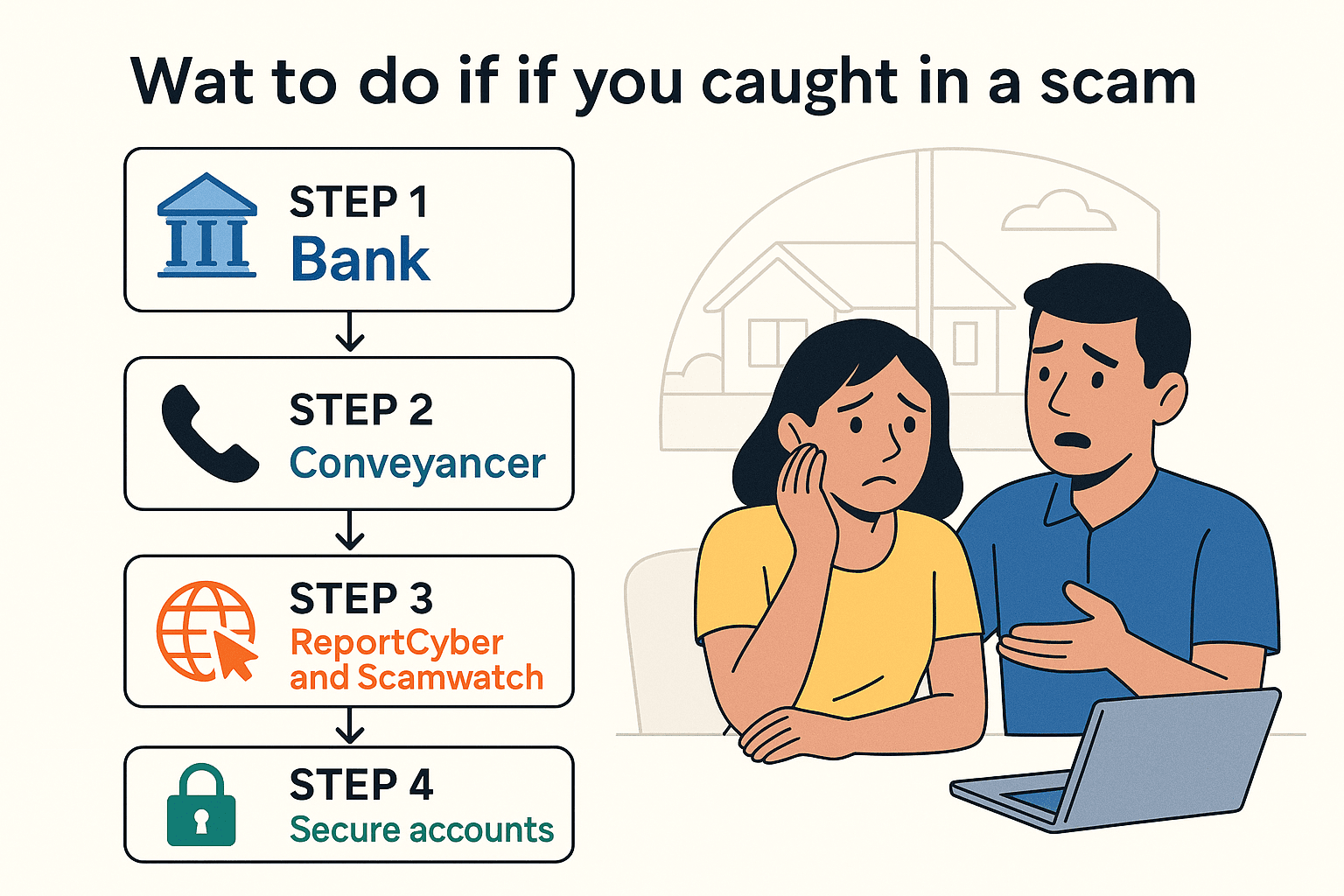

What to do if you are caught in a scam

Even with strong habits, things can go wrong. Maybe you were distracted, under pressure, or simply unlucky. If you suspect you have sent money to a scammer, speed is everything. As one white paper notes, once the money is sent, the scammers quickly withdraw or launder the funds, making recovery difficult.* The faster you act, the better your chances.

Your first move is to contact your bank immediately. Tell the bank you believe you have been part of a property settlement scam and ask them to try to freeze or recall the payment. Many banks have specialist teams for scams Australia wide and can act quickly if they get the alert in time. Next, contact your conveyancer or solicitor so they can document what has happened and support any follow up. They may also warn other parties in case the scammer is still active in the email chain.

After those calls, report the incident. For many people this is the moment when they ask what to do when scammed out of money or what to do if you get scammed in a property deal. In Australia you can make a report through Report Cybercrime, the national online cybercrime portal, and log the case with the National Anti-Scam Centre, which is run through accc scamwatch. These reports help law enforcement look for patterns and, in some cases, may support efforts to recover funds. If your identity details were exposed, services like IDCARE can guide you through locking down your accounts.

Take a simple example. You are buying a $600,000 townhouse with a 5 percent deposit of $30,000. You accidentally send the $30,000 to a wrong account after following a fake email. You notice the mistake within an hour. You call your bank straight away, then your conveyancer, and then lodge a ReportCyber complaint. In this scenario the bank may be able to freeze the funds before they move. If instead you wait a day, the funds may already be gone. This shows why guides on how to get money back from scammer situations stress immediate action.

Once the urgent steps are done, look after yourself. Being scammed feels awful and can be embarrassing, but it can happen to anyone. Many victims say they knew the warning signs in theory but did not apply them in the moment. The best response is to tighten your security, update passwords, add stronger sign in protection and build a clearer process for the future. For current borrowers who already have a home loan, it is also a good time to review how your lender communicates and whether there are safer ways to handle changes, such as secure in app messages instead of email.

Steps to take if you think you have been scammed

- Contact your bank immediately and ask them to freeze or recall the payment.

- Tell your conveyancer or solicitor what happened so they can help document and respond.

- Report the scam through official channels like Report Cybercrime and ACCC Scamwatch Australia.

- Update your passwords and add extra sign in protections to email and banking accounts.

What this means for Buyers

- Have a written plan for what to do if you have been scammed, including key phone numbers and steps.

- Know that recovering money is difficult, so prevention matters more than chasing refunds.

- After any near miss, review your process and tighten how you confirm payment details next time.

What this means for Current borrowers

- Remember that refinance offers and loan variation emails can also be used as hooks for mortgage company fraud.

- Store your genuine loan account details safely and compare any change requests against that record.

- Talk to your lender about safer ways to manage changes, such as secure messages inside their app instead of email.

Quick Q&A

Q: What to do if you have been scammed in a property transaction and the bank says it is your responsibility?

A: Keep records of all messages, lodge a complaint with your bank, and if needed escalate to the Australian Financial Complaints Authority. While there is no guarantee, regulations now expect banks to show they took reasonable steps to prevent scams, especially large transfers.

Q: What to do if you get scammed but only sent part of the money, for example a smaller holding deposit?

A: Treat it just as seriously. Contact your bank, conveyancer and the official reporting channels. Stopping a scam early reduces damage and can prevent the same criminals from trying to target your full settlement amount later.

Sources

PEXA, “Safeguarding Your Property Settlement: Awareness and Prevention of Scams”, White Paper for Scam Awareness Week 2025, by Graham Fairley, 2025, available as Scam-Awareness-White-paper-final-sm-1756101694.pdf on the PEXA site.

PEXA, “97% Of Aussies Miss Property Scam Warning Signs”, content hub news article, 26 August 2025, www.pexa-group.com.

Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.

Written By

The Craggle Team