Comfortable Borrowing Power Explained

Understand borrowing power for Australian home loans with a home loan calculator that starts from a monthly or fortnightly repayment you choose.

This article explains how borrowing power works for Australian home loans and why it is only an estimate, not a promise. You will see the difference between a bank's maximum borrowing capacity and a comfortable borrowing amount that fits your household budget. We walk through how income, expenses, debts and deposit shape what you might be able to borrow. Most importantly, you will learn how Craggle's borrowing power calculator starts with a monthly or fortnightly repayment you choose, then works backwards to estimate an approximate loan amount and property price range.

Key takeaways

- Borrowing power is an estimate of how much a lender might be willing to lend you for a home loan based on your income, expenses, debts and deposit.

- Maximum borrowing capacity is not always the right number for your life, because your budget also needs room for savings, fun and future rate rises.

- Craggle’s borrowing power calculator lets you start with a monthly or fortnightly repayment that feels comfortable, then works backwards to estimate an approximate loan amount and property price range.

- Once you test a few scenarios, you can compare your comfortable range with real property prices and decide whether to adjust your plans or talk with a lending expert.

What is borrowing power?

Borrowing power, sometimes called borrowing capacity, is the rough maximum home loan amount a lender thinks you can handle. It is based on your income, your regular living costs, any existing debts and the size of your deposit. In simple terms, it is the lender's view of your home loan affordability, not just a random number from a house loan calculator or mortgage estimator.

To work this out, a lender looks at your pay, your partner's pay if you have one, and stable income such as bonuses or rent from an investment property. They subtract a sensible level of day to day living expenses plus things like school fees, private health or subscriptions. They also factor in repayments on credit cards, personal loans, car loans and any other mortgages. The leftover amount is what they think you can safely put towards a home loan repayment.

That figure becomes the base for your borrowing power. For example, imagine a bank decides you can afford about $3,600 per month in repayments. On a 30 year home loan at 6.0 percent interest, that might translate to a loan of roughly $600,000. If you have a 20 percent deposit of $150,000, your total buying power could be around $750,000. You can test a scenario like this in Craggle's home loan calculator by entering a monthly repayment close to $3,600 and seeing what loan amount and property price range appear.

Behind the scenes, lenders also build in a buffer. Serviceability is the term they use for checking whether you can afford the loan if interest rates rise. For example, they may test your borrowing capacity at an interest rate a few percentage points higher than today's rate. This can reduce the maximum figure a bank is willing to show, even if your own budget feels fine at the current rate. The key point is that borrowing power is an estimate based on cautious rules, not a promise that everything will feel comfortable in your real life.

Quick checklist to understand borrowing power

- List your income sources, including salary, rent and any regular side income.

- Write down your main living expenses plus repayments on existing debts.

- Decide on a monthly or fortnightly repayment that feels safe after bills and savings.

- Use the Craggle borrowing power calculator to see what that repayment might translate to as a loan amount and rough property price.

What this means for Buyers

- Borrowing power is a guide, not a target, so you do not need to stretch to the absolute maximum a bank suggests.

- Your true comfort line may sit below the bank's number, especially if you value a strong savings buffer.

- Use the calculator like a home loan borrowing calculator, starting from a repayment that fits your lifestyle, then check if the resulting price range lines up with areas you like.

Quick Q&A

Q: Does borrowing power show exactly how much I will be allowed to borrow?

A: No. It is a best guess based on current information and lending rules. The final decision depends on the full application, credit checks and the lender's policies at the time.

Q: Is borrowing power the same as a comfortable borrowing amount?

A: Not always. Borrowing power reflects what a lender thinks is manageable. A comfortable borrowing amount is what you feel happy repaying without stress, which may be lower.

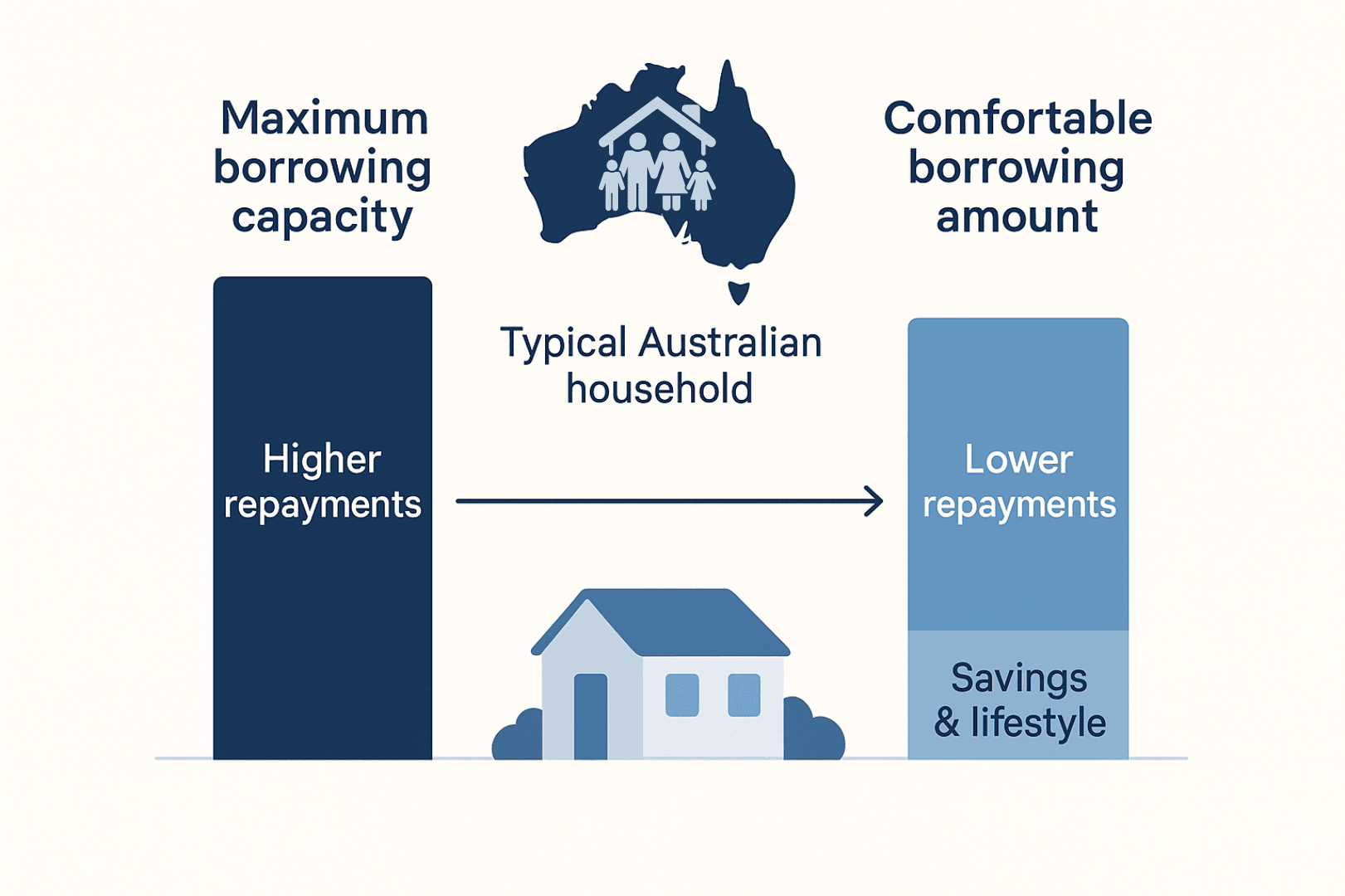

Borrowing power vs comfort

It is easy to focus on the biggest number a mortgage borrowing calculator or a bank shows you. That maximum borrowing limit can be exciting, but it does not know how you like to live your life. Comfortable borrowing is about the repayment that fits your real budget after groceries, fuel, kids, pets, holidays and surprise bills. Those everyday choices matter more than what a line on a screen says.

Think of it this way. A lender's test is designed to make sure you do not default on your loan, even if interest rates rise. It is not designed to make sure you can still enjoy weekends, eat out sometimes or save for future goals. A couple may pass a bank's test for $4,500 per month in repayments, yet feel far more relaxed at $3,500 per month. The bank cares about minimum safety. You care about loan affordability that still leaves room for the life you want.

Imagine a couple with a combined income of $180,000 a year. After tax, they might bring home around $11,000 a month. A lender might say their borrowing capacity supports a repayment close to $4,200 a month. That could equal a loan of about $700,000 at a 5.8 percent rate over 30 years. But this couple might decide that $3,200 a month is the top of their comfort zone. If they put that repayment into Craggle's borrowing power calculator, the estimated loan might drop to around $530,000. That is a big difference, and it shows why comfort comes first.

Craggle flips the usual question from "How much can I borrow?" to "What repayment feels right?" Instead of chasing the highest result from an online borrowing calculator, you start with a monthly or fortnightly amount that fits your budget. The calculator then estimates the loan size and property price that sit behind that repayment. This approach lets you compare a rough amount you can borrow for a mortgage with what you actually want to spend each month.

Checklist to find your comfort zone

- Work out your average monthly income after tax using an income and mortgage calculator or your pay slips.

- Subtract all regular bills, groceries, fuel, childcare and a realistic amount for fun and savings.

- Look at what is left and choose a repayment that feels safe, not stretched.

- Enter that repayment into Craggle’s calculator as your starting point, then adjust up or down to see how your borrowing range changes.

Related reading: Borrowing and budgeting

- Borrowing Capacity Calculator - How Much Can I Borrow?

- Mortgage Affordability Calculator

- First Home Buyer Buffer Hack: 2 Step Loan Strategy

What this means for Current borrowers

- If rate rises have squeezed your budget, your true comfort level may now sit below your original repayment.

- You can use the calculator like a quick home loan calculator to test what a lower repayment might mean for refinancing options.

- Seeing the gap between maximum borrowing and comfortable borrowing can help you decide if you need to change loan structure or property plans.

Quick Q&A

Q: Why do I feel stretched if I passed the bank's serviceability test?

A: The test uses standard living cost assumptions and stress rates. Your real spending might be higher, and the bank's model does not factor in your personal goals or comfort level.

Q: Should I always borrow less than my maximum borrowing capacity?

A: In many cases, yes. A lower borrowing level that matches a repayment you can afford comfortably is often safer than pushing right to the limit.

How the Craggle calculator works

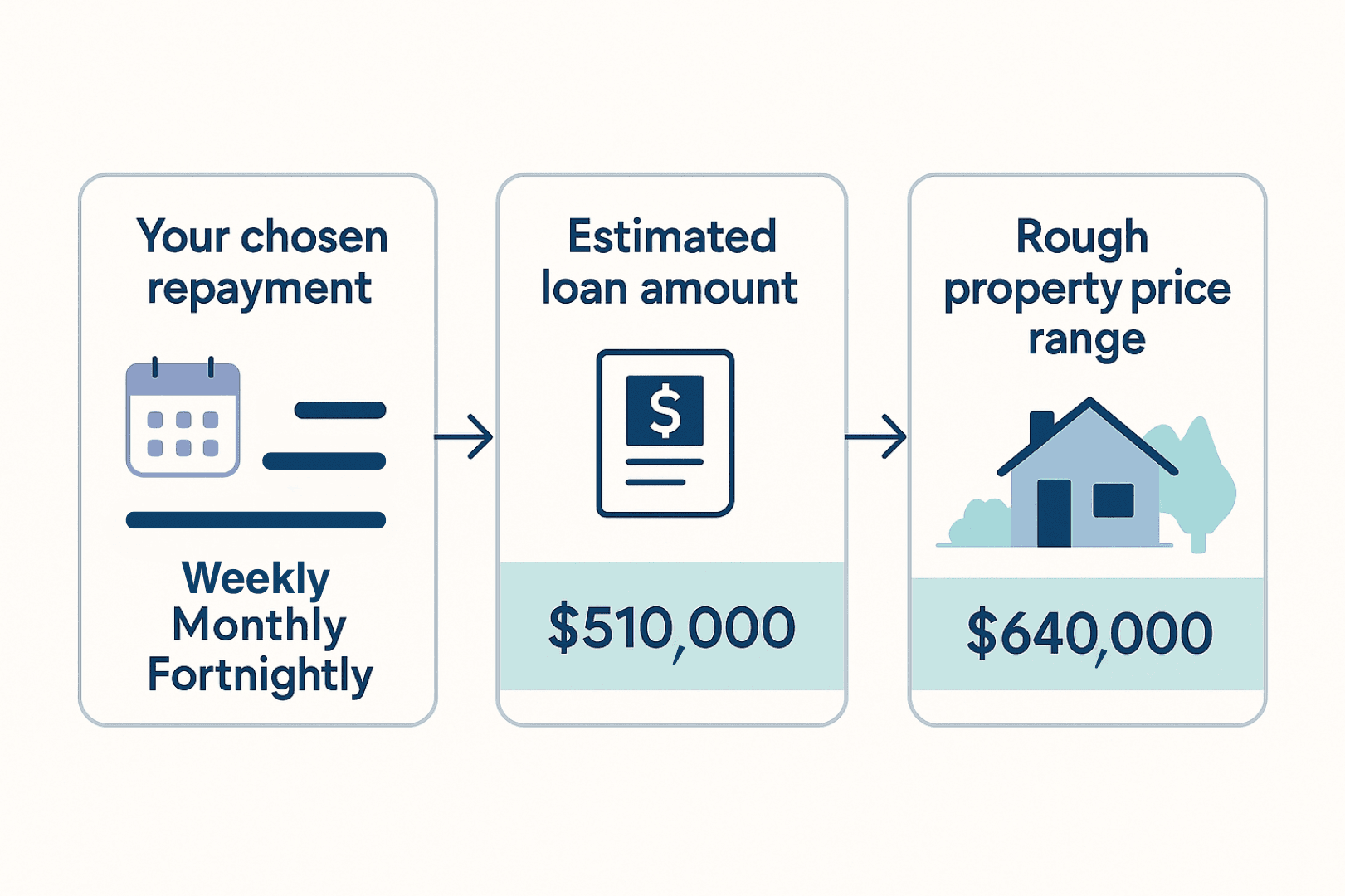

Most tools start by asking what property price you want or how much home loan you think you need. Craggle's borrowing power calculator takes a different path. You begin by choosing a repayment, either monthly or fortnightly, that feels right for your budget. The calculator then uses your chosen interest rate, loan term and deposit to estimate an underlying loan amount and a rough property price range.

Here is the simple idea. When you enter a repayment, the calculator asks, "What size loan would create this repayment at the given rate and term?" If you tell it you can handle $3,000 a month at 5.8 percent over 30 years, the calculator might estimate a loan of around $510,000. If you also say you have a 20 percent deposit, it will show a property price near $640,000. Change the repayment to $2,500 a month and the estimated loan and price adjust down. Switch to a fortnightly repayment and you will see how that pattern plays out in smaller, more frequent payments.

The maths behind this is standard loan maths. The calculator spreads the loan over the number of months or fortnights in your loan term, applies the interest rate and works out the repayment that would pay the loan down to zero. Craggle simply runs that logic in reverse. You give it the repayment and it works backwards to estimate the loan. It behaves like a home loan estimator or mortgage calculator australia, but with comfort as the starting point.

Because the tool is a guide, the results are estimates only. It is not a loan offer, not a credit check and not a guarantee of approval. Your bank or broker will still need to run a full serviceability check using their own rules, buffers and policies. The big win is that you arrive at that conversation already clear on what repayment works for you, rather than chasing the largest number from a mortgage loan calculator australia.

Steps to use the Craggle calculator

- Pick a repayment amount you feel good about, such as a monthly figure that fits your budget.

- Choose whether you want to see results in monthly or fortnightly terms.

- Enter an interest rate, a loan term and your expected deposit amount.

- Review the estimated loan and property price, then adjust the repayment or rate to test different scenarios.

What this means for Buyers

- You can treat the tool as a home loan borrowing calculator that respects your comfort level instead of pushing you to stretch.

- By playing with repayment amounts and deposits, you can see how things might look if rates move or your savings grow.

- You get a clearer idea of what suburbs and price points match your budget before you fall in love with a property.

Quick Q&A

Q: Does using Craggle's calculator affect my credit score?

A: No. It is a planning tool only. You can run as many scenarios as you like without creating any mark on your credit file.

Q: Is the result from the calculator the same as a loan approval?

A: No. The results are estimates based on the numbers you enter. A lender will still need to check your full situation before offering a loan.

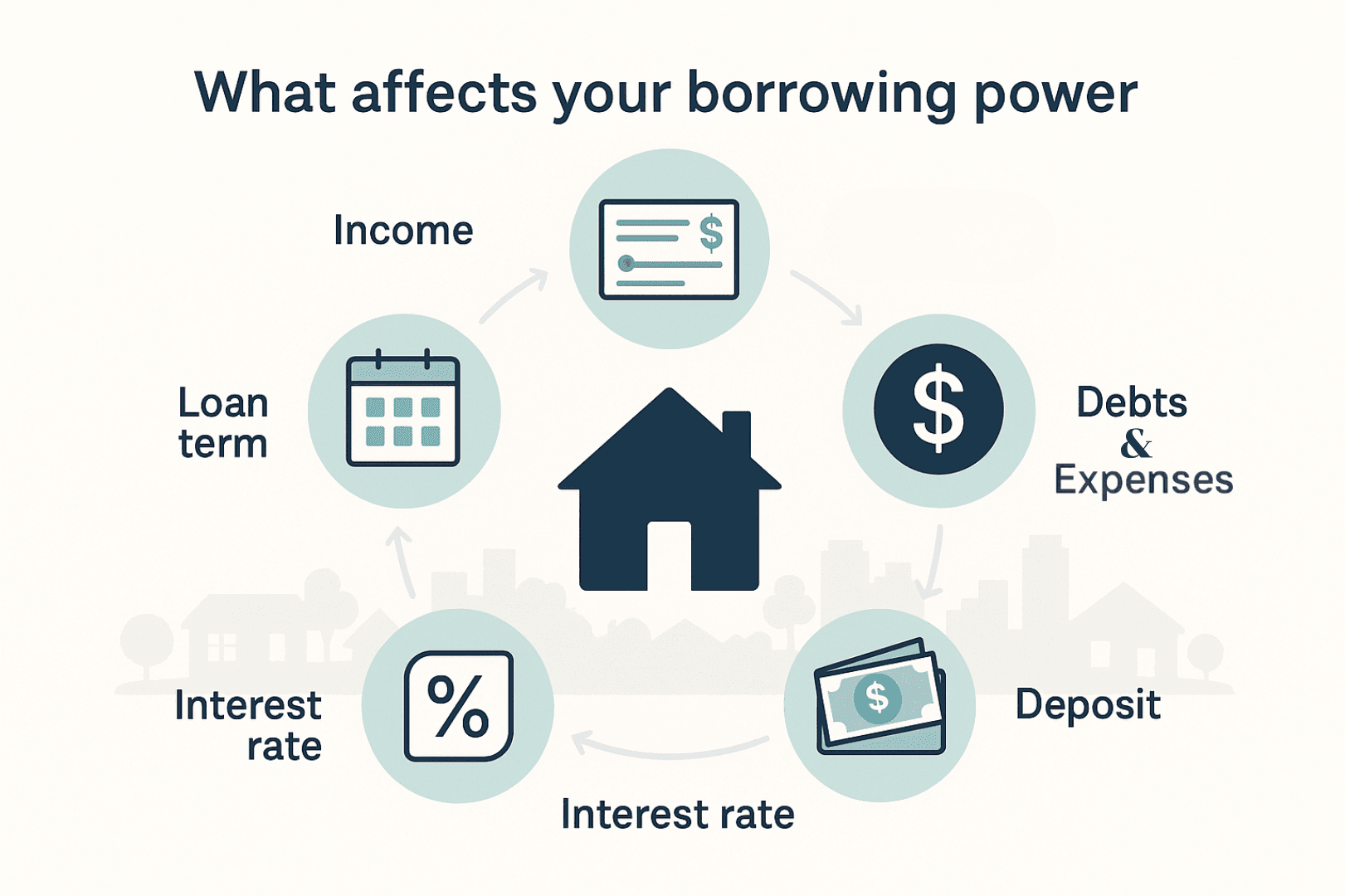

What affects your borrowing power

Your borrowing power is not just about income. Lenders look at a mix of factors to decide how much they are comfortable lending. The main ones are income, living expenses, debts, deposit, interest rate and loan term. Together, they shape your lending capacity and the level of mortgage borrowing a bank thinks you can manage.

Income is the starting point. Salary, wages, regular overtime and rental income all help. Stable employment, such as a long term role or consistent self employed income, usually supports stronger borrowing capacity than short term or casual work. On the flip side, higher living costs reduce the amount you can put towards repayments. Banks use a mix of your declared expenses and standard living cost benchmarks to estimate what you spend.

Existing debts also have a big impact. A credit card with a $10,000 limit is usually treated as if you are making repayments on that full limit, even if you keep the balance low. Personal loans, car loans, buy now pay later accounts and other mortgages all eat into the pool of money left for home loan repayments. The more you owe elsewhere, the lower your home loan power is likely to be.

Your deposit and the loan to value ratio, or LVR, also matter. LVR is the percentage of the property price that you are borrowing. For example, if you buy a $600,000 property with a $120,000 deposit, your LVR is 80 percent. Lower LVRs often mean better rates and more lender options. Interest rates and the length of the loan term also change borrowing power. A lower interest rate or a longer loan term lowers repayments on a given loan size, which can lift your calculated capacity, although it may mean paying more interest over time. When you enter different rates or terms into the Craggle calculator, you see these forces in action.

Checklist to review your borrowing drivers

- List your total household income, including salary, rent and regular extras.

- Write down all credit cards, personal loans, car loans and other debts with their limits or balances.

- Estimate your deposit and work out your likely LVR on your target property price.

- Use the Craggle calculator or an online borrowing calculator to see how small changes in debts, deposit or rate shift your estimated borrowing range.

What this means for Current borrowers

- Paying down other debts or lowering credit card limits can free up borrowing capacity for a refinance or a new purchase.

- Improving your savings or using a deposit calculator mortgage tool can reduce your LVR and sometimes unlock better rate options.

- Understanding how lenders see your situation helps you decide what to change before you apply.

Quick Q&A

Q: Do lenders look at my actual spending or just a standard benchmark?

A: Most lenders use a mix of both. They ask about your real expenses and also check against standard living cost benchmarks to make sure your figures look reasonable.

Q: Will a higher deposit always increase my borrowing power?

A: A higher deposit usually helps by lowering your LVR and sometimes your interest rate. But your income and debts still need to support the repayments on the loan amount you want.

Ways to boost your borrowing power safely

If your first run through a mortgage borrowing calculator leaves you short of the price range you were hoping for, there are safe ways to improve the picture. The key word is "safely". You want to increase your borrowing capacity without tipping your budget into stress. Small shifts in debts, spending and deposit can make a meaningful difference.

One of the most powerful steps is reducing unsecured debts. Paying down personal loans or trimming credit card limits means fewer repayments that lenders need to factor in. Even lowering a card limit from $15,000 to $5,000 can improve the way your application looks. Trimming non essential spending for a while can also help, especially if it lifts your savings rate and shows a stronger recent bank statement history.

Growing your deposit over time is another lever. Saving for a bit longer, using a first home buyer calculator to see what grants or schemes you might access, or directing bonuses into a savings account can gradually reduce your LVR. A lower LVR can expand your lender options and may nudge your borrowing power higher. Adjusting expectations about location, property type or features is also part of boosting your overall plan without putting extra pressure on repayments.

Craggle's calculator makes it easy to see the impact of each change. After paying down a loan or cutting a card limit, you can enter the same comfortable repayment and watch how the estimated loan amount shifts. You can also test a scenario where you increase the repayment a little, such as from $2,400 to $2,600 per month, and see if that still feels manageable when you compare it with your budget.

Checklist to lift capacity without extra stress

- List all non mortgage debts and create a plan to pay down the most expensive ones first.

- Reduce unused credit card limits where possible to cut the impact on your application.

- Set a clear savings goal for your deposit and track progress monthly.

- Use the Craggle calculator to see how changes in debts, deposit and repayment comfort affect your estimated borrowing range.

What this means for Buyers

- You may not need to completely reset your property dreams. Strategic tweaks to debts and deposit can open more options.

- Boosting borrowing power should never mean ignoring your comfort level or removing your buffer for rate rises.

- Seeing results in a calculator that starts from your chosen repayment makes it easier to stay honest about what you can afford.

Quick Q&A

Q: Is it worth delaying my purchase to save a larger deposit?

A: In many cases, yes. A larger deposit can lower your LVR, reduce the need for lender's mortgage insurance and sometimes support stronger borrowing capacity.

Q: Will cutting my lifestyle hard for a few months help my application?

A: Short term cuts can boost savings, but lenders also look for a sustainable pattern. Aim for realistic, long term spending habits that match the repayment you plan to take on.

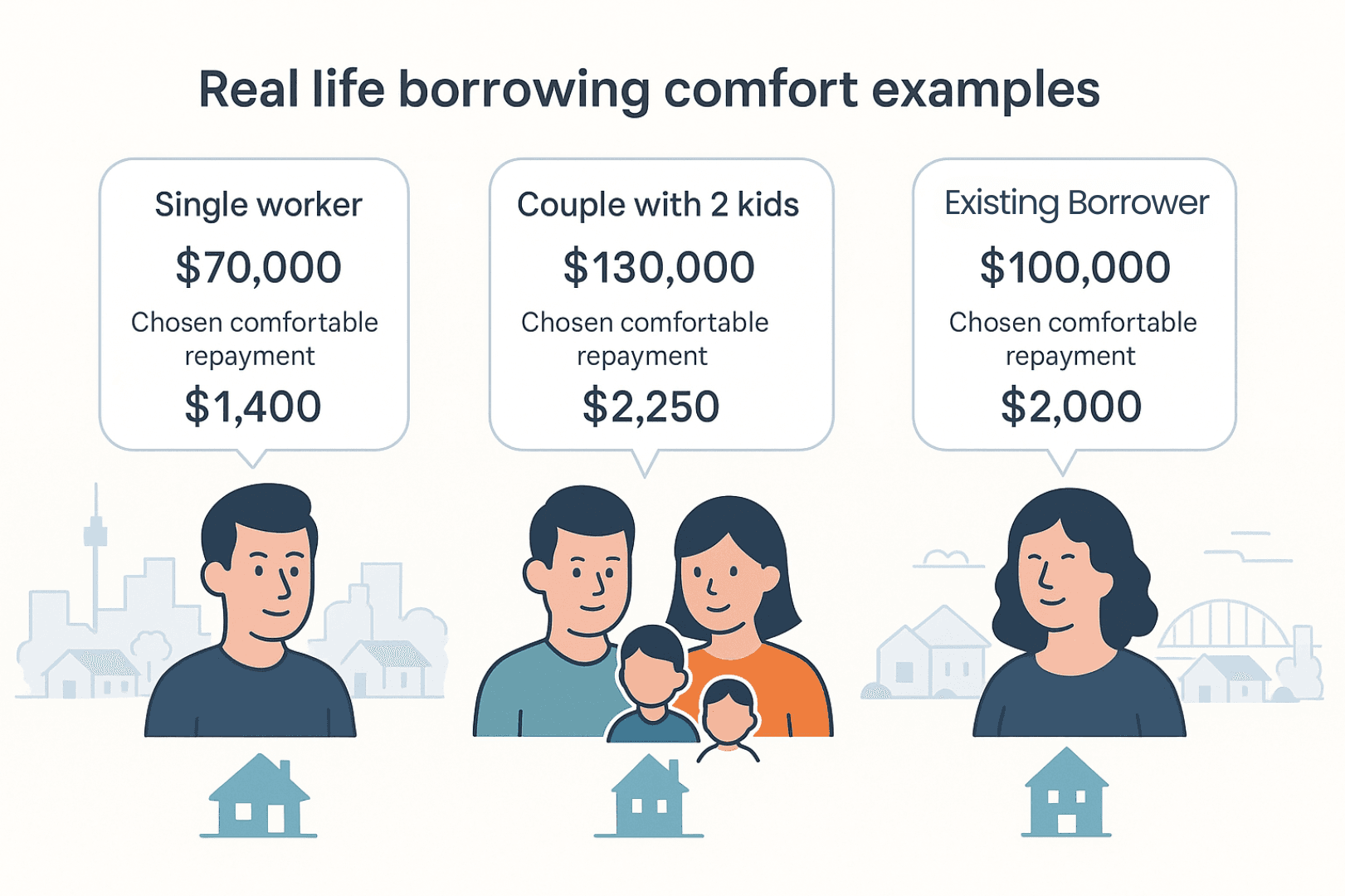

Real life borrowing comfort examples

Sometimes examples make things click. Here are a few simple Australian scenarios that show how comfort, income and repayments work together. These are not rules. They are stories to help you picture how Craggle's calculator can support clearer choices.

Case 1 is a single person on a $90,000 salary in Sydney. After tax, they take home roughly $5,400 a month. After rent, bills, food, transport and a bit of fun, they decide that $2,000 a month is the maximum home loan repayment they would feel comfortable with. Put that into the calculator with a 5.9 percent rate and a 30 year term and it might estimate a loan of around $340,000. With a 15 percent deposit of about $60,000, they could target properties around $400,000. That might point them towards smaller units or regional areas instead of trying to stretch into a higher bracket.

Case 2 is a couple in Brisbane with a combined income of $180,000 and two kids. Their after tax income might be about $11,000 a month. Childcare, activities and groceries are not cheap, so they choose a comfortable repayment of $3,500 a month rather than the $4,500 that a simple mortgage calculator based on income might suggest. With that $3,500 repayment at a 5.9 percent rate over 30 years, the calculator could estimate a loan near $590,000. With a $160,000 deposit, they are looking at homes around $750,000, which may suit their preferred suburbs without leaving them stretched.

Case 3 is a current borrower in Melbourne with an existing $500,000 loan, 25 years remaining and a repayment of about $3,600 a month after recent rate rises. They feel squeezed and are thinking about refinancing. Using the Craggle calculator as a refinance equity calculator, they test what happens if they target a $3,000 monthly repayment instead. They can see how much lower the loan amount would need to be, and whether selling, downsizing or using extra savings to pay off a chunk of the loan could get them back to a more comfortable level.

Checklist to run your own example

- Pick the example above that feels closest to your situation.

- Swap in your own income, deposit and comfort level for repayments.

- Enter those figures into the Craggle calculator and see what loan and property range it suggests.

- Adjust the numbers to see how changes in repayment or deposit shift your options.

Related reading: Buying and housing affordability

- Your Beginners Guide to Buying Property

- Perth Housing Affordability: Challenges & Solutions

- Melbourne Housing Affordability: Challenges & Solutions

What this means for Buyers and Current borrowers

- Real numbers make the trade offs clear, so you are not guessing about what feels affordable.

- You can see how much power your chosen repayment has over the type of home and location you can target.

- Existing borrowers can test whether a refinance or a change in property might ease repayment pressure.

Quick Q&A

Q: Can I use these examples as a template for my own situation?

A: Yes. Treat them as a starting point. Replace the incomes, deposits and repayments with your own numbers and run them through the calculator.

Q: What if my comfort level is very different from the examples?

A: That is fine. Comfort is personal. The important part is that you choose a repayment that fits your life and then see what that means for borrowing power.

Next steps after using the calculator

Once you have played with a few scenarios in Craggle's calculator, the real work begins. You will usually end up with a range of repayments that feel comfortable and the matching loan and property price ranges. The next step is lining those ranges up against real homes in the suburbs you like, using a property calculator or local listings to cross check what is realistic.

If your comfortable range and local prices match up, you are in a strong position. You can focus your search, talk with agents more confidently and keep a clear eye on your budget during negotiations. If there is a gap, you have choices. You might look slightly further out, consider a smaller place, extend your savings timeframe or explore options like a guarantor home loan calculator scenario to see if family support could help.

It is also a good time to gather your paperwork. Lenders and brokers will want payslips, tax returns, bank statements and details of all debts. Having these ready speeds up the process when you are ready to move from online estimates to a real application. Craggle's calculator is not a mortgage serviceability calculator in the strict bank sense, but it helps you arrive at that stage with a clear, well tested repayment target.

Finally, you can choose whether to talk with a lending expert. A good broker or lender will not push you to the edge of your borrowing power. Instead, they can help check whether your comfortable repayment still stacks up under their tests and whether different loan structures, such as a split loan or different terms, might give you more flexibility while staying within your comfort zone.

Checklist for life after the calculator

- Save or write down your preferred repayment and the matching borrowing range from the calculator.

- Compare that range with real property prices in your target areas.

- Decide if you need to adjust your search, timeline or savings goals.

- Prepare key documents and consider speaking with a lending expert when you feel ready.

What this means for Buyers and Current borrowers

- Instead of going into lender meetings blind, you turn up with a clear repayment range and realistic expectations.

- You can avoid being swept up in property hype by using your comfortable repayment as a firm anchor.

- Existing borrowers can use the same process to test refinance options and plan their next steps calmly.

Quick Q&A

Q: What if the calculator shows I cannot afford the kind of property I want yet?

A: That is valuable information. You can adjust your plans, focus on saving more, reduce debts or look at different areas rather than taking on a loan that feels too tight.

Q: When should I talk with a lending expert after using the calculator?

A: Once you have a clear comfort range and a rough idea of property prices, talking with an expert can help you confirm your options and understand the next steps in the application process.

Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.