Home Of Fair Facts & Tips

What makes up the dream Australian home?

Dream home features in Australia: see today's must-haves buyers want, from bedrooms to air con, and learn how to weigh them against your budget.

What makes up the dream Australian home is shifting: comfort inside the home now ranks alongside space and backyard appeal. This guide turns those preferences into a simple plan for buyers. You will learn how to weigh must-haves against nice-to-haves, set a realistic budget, and match loan options to the features you value. Examples use Australian numbers so you can sense the trade-offs before you inspect.

Key takeaways

- Bedrooms and climate control sit at the top of many Australian wish lists, with outdoor extras ranking lower.

- Translate preferences into a budget using clear trade-offs: location, size, and finish.

- Use borrowing capacity and a simple price ladder to test must-haves vs nice-to-haves.

- Compare home loans early so your structure suits the features you pick.

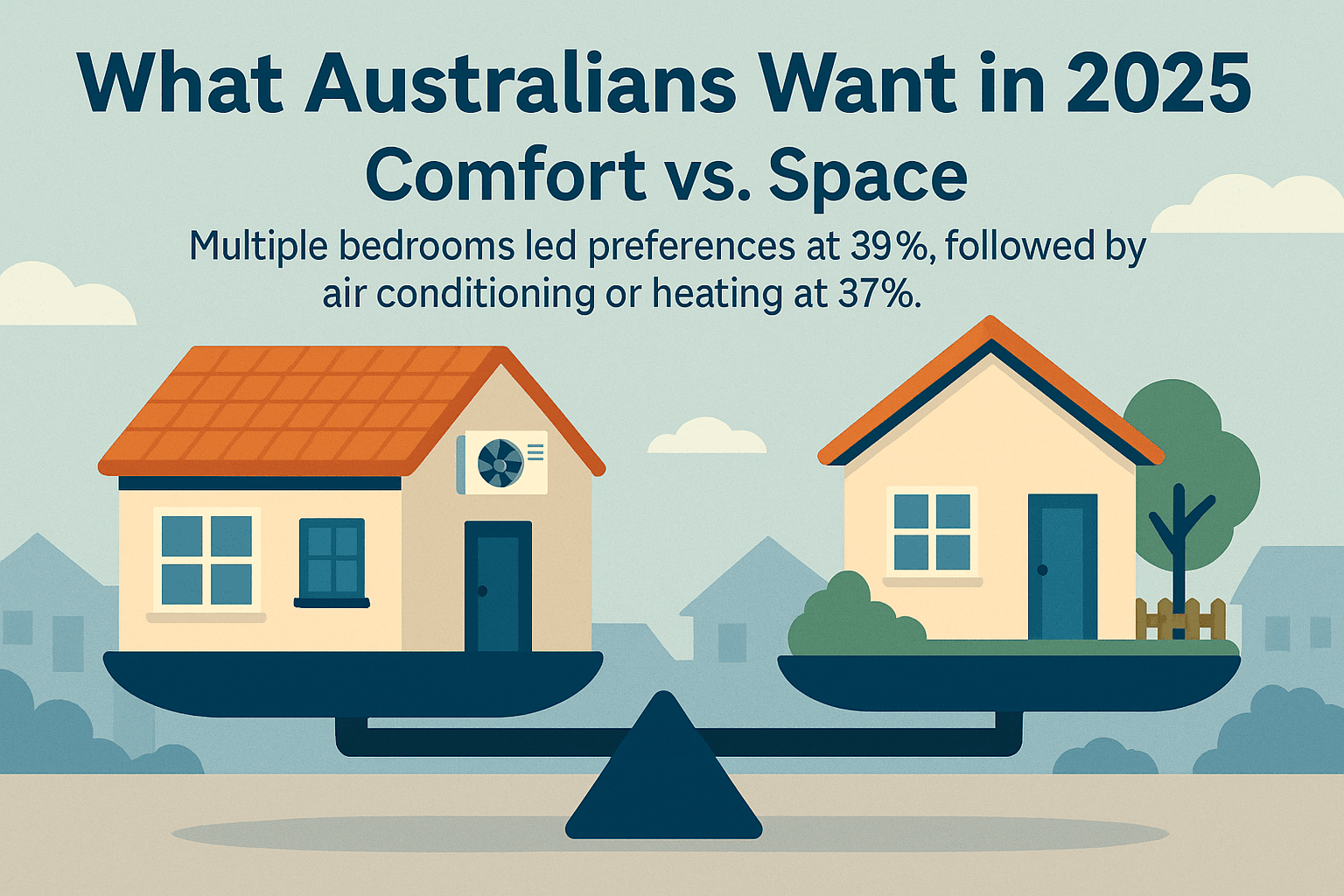

What Australians Want in 2025

Fresh survey results show Australians prioritise comfort and bedroom count when picturing a dream home. Multiple bedrooms led preferences at 39%, followed by air conditioning or heating at 37%. A backyard sat in the next tier at roughly one in four people. Pools, balconies and carports were far less popular, with pools the most commonly listed “least-wanted” feature. “Whether your dream home is a house, apartment, townhouse or duplex, it’s important to shop around,” Mr Zeller said.*

Detached houses remain highly appealing, yet many buyers now trade backyard size for better interiors, storage and climate control. That shift fits with Australia’s heat and the convenience of reverse-cycle systems. It also reflects floor plans that give kids their own rooms and allow a compact yard with smart landscaping rather than a large lawn to maintain.

Worked example: say you are weighing two homes in Brisbane at similar prices. Home A has three bedrooms, ducted air and a small courtyard. Home B has two bedrooms, a big yard and no air con. If summer cooling costs average $120 per month for split systems and the courtyard saves $40 in gardening, the real difference is utility and comfort: the extra bedroom may support a growing family or home office, increasing long-term value to you more than yard size.

Quotes from the survey add a helpful frame: “A house with a lot of desirable attributes may cost more. Therefore, it’s important for people to find out what their ‘must-haves’ are and what their budget is.”* Use that idea to separate your list before you inspect.

Turn survey results into action

Three simple levers show up in the data: bedrooms, climate control, and outdoor space. Rank them for your household, then check price impacts suburb by suburb.

- Bedrooms first: match bed count to real needs in the next 5 years.

- Climate control: decide between ducted and split systems based on room use.

- Outdoor space: choose low-maintenance yards or courtyards if you are busy.

What this means for Buyers

- Expect to pay more for homes with extra bedrooms and quality air con.

- Backyard size matters less if nearby parks meet the same need.

- Budget for upgrades if your ideal home lacks one top feature.

Quick Q&A

Q: Are pools a resale must?

A: Not for most buyers today. Many view a pool as optional given maintenance and cost.

Q: Do buyers still want big blocks?

A: Some do, but many prefer better layouts and storage over extra lawn.

Related reading: Plan your budget and must-haves

- Borrowing Capacity Calculator - How Much Can I Borrow?

- Hidden Costs of Buying a Home: What You Need to Budget For

- Home Loan Repayment Calculator

Must-Haves vs Nice-to-Haves: A Clear Plan

Turn your list into a decision you can act on. Start with the top three outcomes your home must deliver: enough bedrooms, year-round comfort, and location access such as school zones or a short commute. Everything else sits below as a “nice-to-have”. “You might need to compromise to find a property that has most of what you want and is in your budget.”*

Use a price ladder. For example, in Melbourne’s middle ring, stepping from a two-bed to a three-bed townhouse can add $80,000 to $120,000 depending on suburb and finish. If your budget is $900,000 and a three-bed option costs $980,000, you can either lift the budget, widen your search, or trim non-essentials like stone benchtops, a large deck or a second living area.

Worked example: total budget $900,000 with a 10% deposit ($90,000) and purchase costs of $35,000. If your borrowing capacity supports $845,000 but listings at that price miss a key must-have, consider nearby suburbs or older homes that allow a staged renovation. Keep the must-have list tight: if an item will not change how you live weekly, it is a nice-to-have.

Reserve one slot for future-proofing. That might be a flexible third bedroom, an energy efficient upgrade path, or a garage that can convert to a home office. These features build liveability without chasing expensive extras like a pool.

Ask for value without overspending

Four high-impact moves help you capture value without chasing every upgrade.

- Trade finish for function: pick quality insulation over designer tapware.

- Choose split-system air con in key rooms now, wire for ducted later.

- Use smart storage to replace a second living zone.

- Pick a smaller deck and spend on shade or landscaping.

What this means for Sellers

- Highlight bedrooms, climate control, and storage in your listing.

- Small, tidy yards with shade can compete with large lawns.

- Simple energy upgrades can lift buyer comfort perception.

Quick Q&A

Q: Do I really need a backyard pool?

A: Not usually. Many buyers prefer lower-maintenance outdoor spaces and nearby parks.

Q: What about a balcony in apartments?

A: Handy, but not essential. Indoor comfort and storage often rate higher.

Related reading: Compare and move faster

- Understanding How Home Loans Work: A Comprehensive Guide

- Our Guide to Winning at Home Loan Negotiations

- Stamp Duty Explained: A Property Buyer's Roadmap

Budget, Borrowing Capacity and Trade-offs

Your features list only works when it fits your budget. Start with borrowing capacity, then add your deposit and costs to set a purchase ceiling. Map this against suburbs and floor plans, not just price medians. If capacity falls short of the three must-haves, the lever is usually location, not quality of life inside the home.

Stress test repayments at a rate buffer. If advertised variable rates are 5.9% to 6.3%, model 6.8% to 7.3% to stay safe. That protects your comfort spend on air con, insulation and storage if rates move. Get early home loan pre approval so you can act quickly once your plan is clear.

Worked example: total budget target $1,050,000 in Sydney’s north-west with a 20% deposit of $210,000. With borrowing capacity of $900,000 and costs of $40,000, your ceiling sits near $1,140,000, which is over the target. To stay under $1,050,000, consider a nearby suburb or swap a fourth bedroom for a larger third bedroom plus built-ins. You keep what matters weekly while avoiding features you will not use.

Think in trade-offs. A home with three bedrooms and strong storage near a school can beat a four-bed home on a longer commute. Energy efficient homes with insulation and shading can also reduce bills, freeing cash for better location or layout.

Three money levers that protect liveability

Use these in order before you cut a must-have.

- Location radius: widen by 2–3 stations or a 10-minute drive.

- Property type: pick an older home with solid bones and upgrade over time.

- Loan structure: compare variable, fixed, or split to suit cash flow.

What this means for Current borrowers

- Refinance can support a move if the new loan lowers repayments.

- Split loans can stabilise cash flow while you renovate.

- Offset accounts help fund staged upgrades without losing flexibility.

Quick Q&A

Q: Should I lock a fixed rate for upgrades?

A: A partial fix can help budgeting. Keep a variable portion for flexibility.

Q: How do I compare variable and fixed rates?

A: Use the comparison rate and check revert terms, fees and offset access.

Floor Plans, Storage and Liveability

Liveability often beats raw size. A great floor plan places bedrooms away from living areas, keeps noise down, and gives you storage where it counts. Buyers also prefer flexible rooms: a study that turns into a nursery, or a garage that can host a gym. Climate control matters too. Reverse-cycle split systems in main living and the master bedroom can be a smart start, with wiring for ducted later.

Outdoor spaces can be compact and still useful. Shade sails, a paved area, and drought-tolerant planting reduce maintenance and water bills. If the block is small, a well-designed deck with privacy screens can outperform a big lawn for everyday use.

Worked example: Adelaide house at $750,000 with a 15% deposit ($112,500) and costs of $30,000. You shortlist two three-bed homes. Option 1 has a large yard but limited storage and no air con. Option 2 has built-ins, two split systems, and a courtyard. If summer cooling averages 2 kWh per hour for 5 hours on hot days, Option 2 offers comfort and order for similar running cost to ceiling fans plus portable units.

Plan upgrades in phases to avoid overcapitalising. Start with insulation, sealing, and shading. Add storage systems. Then consider ducted air or a second living zone if you still need it. The goal is a calm, low-maintenance home that fits your budget and routine.

Design choices that work hard

Here are four choices that deliver daily value.

- Built-in storage: wardrobes, pantry pull-outs, and garage shelving.

- Light and shade: eaves, blinds and trees reduce heat load.

- Room zoning: keep bedrooms away from living noise.

- Smart laundry: compact layout with external access saves steps.

Quick Q&A

Q: Which storage solutions matter most?

A: Built-ins in bedrooms and a strong pantry deliver the biggest daily wins.

Q: Are energy upgrades worth it now or later?

A: Start with insulation and shading. Add bigger systems when cash flow allows.

Sources

* Backyards and Bedrooms: What makes an Aussie dream home?: Compare the Market, Lachlan Moore; 2025

Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.

Written By

The Craggle Team