Home Of Fair Facts & Tips

Smarter Ways to Fund Your First Home

Discover support options for first home buyer deposits, from 5% deposit schemes to family support and smarter savings strategies.

Buying your first place can feel huge, but you do not have to tackle it alone. This article breaks down the main ways Australians can fund a first home, from government deposit schemes to grants and careful family help. You will see simple examples that show how a 5 percent deposit can stack up against a 20 percent deposit. We will also unpack risks around gifts, loans and guarantees from parents, so you can protect both your budget and your relationships. By the end, you will have a clear plan for the next steps on your path to the front door.

Navigate this article

First home buyer support in AustraliaThe 5 percent deposit Home Guarantee Scheme

Bank of Mum and Dad and family guarantees

Key takeaways

- You do not always need a 20 percent deposit to start buying your first home.

- Help from parents can be powerful, yet the structure of that help affects your borrowing power.

- Talking through all your options before you tap family support can save stress later.

First home buyer support in Australia

If you are a first time homebuyer, the hardest part is often pulling together a deposit while rent and living costs keep rising. It can feel like everyone else had secret help and you missed the memo. The good news is that support for buying your first home has never been more varied, as long as you know where to look and how each option works.

Many first time buyer stories now include some form of family help. A recent Household Budget Barometer report found that parents chipped in a median of about $40,000 to grow their children's deposits, which is a big boost for a typical starter home deposit in Australia. That "extra" money can close the gap faster, but it also raises questions about fairness between siblings, tax and what happens if things go wrong.

On top of family support, there is government help to buy a house in the form of grants, concessions and low deposit programs. These sit alongside your own savings to create a full funding picture. Think of three main buckets working together for help for first time home buyers: your regular savings, one off boosts such as grants or a gift, and special structures like a government guarantee scheme home loan that let you buy with a smaller deposit.

Here is a simple example. Say a property costs $600,000. A classic 20 percent deposit is $120,000, which can feel out of reach. If you saved $30,000 yourself, received a $20,000 gift from parents and qualified for a $10,000 grant, you would already be at $60,000. Add a 5 percent deposit scheme on top and you could be much closer to purchasing your first home sooner than you thought, without waiting to hit a full 20 percent target.

States and territories also offer First Home Owner Grants and stamp duty discounts, which can add thousands of dollars of value. Some regions provide grants of around $10,000 to $30,000 for new builds or specific price ranges, along with stamp duty exemptions or concessions for eligible buyers. These programs can be a real first home buyer benefit if you match the rules. This is where checking first home buyer eligibility for your state becomes important, rather than assuming the same rules apply everywhere.

There are also tools designed to help first home owners plan and track progress, such as budget planners, deposit savings calculators and rent versus buy calculators. When you look at these side by side, you start to see a full picture: how much you can comfortably save each month, what price range might suit you, and how support options could shorten the journey for a 1st home buyer without overloading future repayments.

Simple steps to map your support options

- List your current savings, income, rent and other big bills in one place.

- Use a deposit savings calculator and rent versus buy tool to test different timelines.

- Check government websites for grants, stamp duty concessions and other help for 1st time home buyers in your state.

- Have an honest early chat with family about whether they can help, and in what form, before you rely on that money.

What this means for Buyers

- You can break the deposit problem into smaller steps instead of chasing one huge number.

- Combining savings, grants and other support can make buying your first home realistic sooner.

- Looking at your budget first gives you a clear view of what repayments you can actually afford.

Quick Q&A

Q: As a first time buyer, do I really need a 20 percent deposit?

A: No. A 20 percent deposit is handy because it usually avoids extra insurance costs, but many first time home buyer journeys now start with 5 to 15 percent. The key is making sure the loan size still fits your budget.

Q: I feel behind compared with friends who already own. Is that normal?

A: Yes. Everyone's money story is different. Some people have quiet family help, others do not. Focus on the pieces you can control, like building a savings habit, checking what support you qualify for and setting a realistic plan as a first time home buyer.

Related reading: First home buyer schemes

- First Home Loan Deposit Scheme for First-Time Buyers

- 7 Hacks to Help You Save for a 20% Deposit

- Deposit Savings Calculator

The 5 percent deposit Home Guarantee Scheme

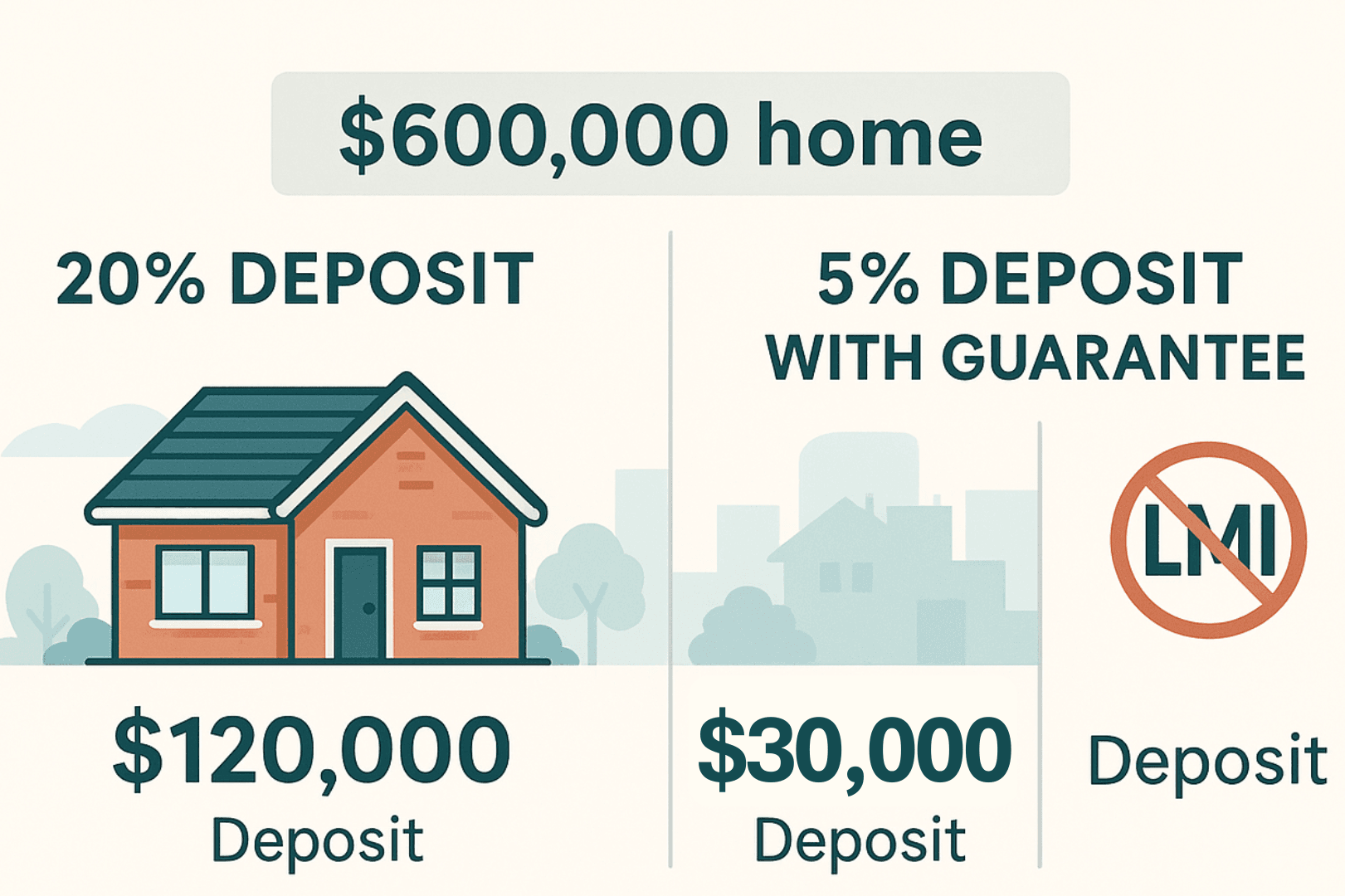

The Australian Government 5 percent Deposit Scheme lets eligible buyers purchase a home with as little as a 5 percent deposit and no Lenders Mortgage Insurance, often called LMI. LMI is an extra cost that normally applies when your deposit is under 20 percent. Under this scheme, the government guarantees part of the loan so your lender treats you as if you had a bigger deposit and you skip LMI premiums.

In simple terms, a government guarantee scheme home loan shares some of the risk between your lender and the government. It does not give you free money, and you still repay the full loan, but it reduces the upfront cash needed. The program was previously known as the Home Guarantee Scheme, and you may still see people use phrases like first home guarantee scheme or home buyer guarantee scheme when they talk about it. Those labels all point back to the same broad idea of a low deposit pathway supported by the government.

There is also a stream called the family home guarantee scheme. This supports eligible single parents or single legal guardians with at least one dependent child to buy a home with a deposit as low as 2 percent and still avoid LMI, as the government's guarantee covers the rest of the usual deposit gap. Many people shorten this to the fhg scheme, which can be confusing because lenders also talk about "family guarantees" in a different way.

Let us use numbers again. Take the same $600,000 property. With a 20 percent deposit, you would need $120,000 plus costs. With a 5 percent deposit under the home guarantee scheme, the deposit part drops to $30,000. You still pay normal purchase costs like conveyancing and government fees, but skipping LMI can save many thousands of dollars. For some buyers, that is the difference between getting into the market now and waiting several more years.

Of course, there are rules. The scheme is aimed at people buying their first place to live in, not investors, and there are property price caps and other conditions. Places are limited and loans are only available through participating lenders. This is why checking first home buyer eligibility early matters. The official FirstHome tools and checklists can help you understand whether you fit the basic settings before you start paying for valuations or legal work.

The scheme also plays a role when builders or developers market first home buyers house and land packages. Low deposit programs can make those packages feel more reachable, but it is still important to review the total repayment commitment, not just the deposit hurdle.

Steps to explore the 5 percent deposit option

- Confirm that you are a first time homebuyer who plans to live in the property, not rent it out.

- Check the latest property price caps and any income or other conditions for your area.

- Use online tools to test different property prices, loan terms and repayment scenarios.

- Speak with a lending specialist who understands the first home guarantee scheme and can explain how it would work for your situation.

What this means for Buyers

- You may be able to buy with a 5 percent deposit rather than waiting to save 20 percent.

- Skipping LMI can save you thousands up front, but repayments will be higher than with a smaller loan.

- The scheme will not fix a weak budget, so you still need to be confident in your regular cash flow.

Quick Q&A

Q: Is the 5 percent deposit scheme only for brand new properties?

A: No. Depending on the stream and your area, you can often use it for established homes, townhouses or apartments, not just new builds. The key is that the property meets the scheme rules and is within the price cap.

Q: Can I use the scheme for an investment property down the track?

A: The scheme is designed for people buying a place to live in. If you later move out and keep it as an investment, that is a separate decision, but you need to meet the live in rules at the start and understand how that fits your long term plans as a first time home buyer.

Related reading: Saving and budgeting for your first place

- Craggle's Smart Budget Planner

- Best Hacks to Pay Off your Home Loan Faster

- Rent Vs Buy: Calculate The Difference Here!

Bank of Mum and Dad and family guarantees

The Bank of Mum and Dad is a casual way of describing parents who help adult children buy property. That help might be a cash gift, an informal loan, or using their own home as extra security on your loan. Recent research suggests this family support now adds up to billions of dollars a year across Australia and ranks alongside some mid sized lenders in scale.

In surveys, parents are reported to contribute a median of around $40,000 towards deposits, often pulled from savings, redraw or investment portfolios. For a typical $600,000 purchase, that one decision can cut your required savings by a third or more. It can move you from "we will be renting for years" to "we might be able to make an offer next year" in one jump.

But structure matters. A cash gift, with no expectation of repayment, usually counts as part of your deposit. A loan from your parents, even if the interest rate is low or flexible, is still a debt that lenders may assess when working out how much you can borrow. A family guarantee, where parents use equity in their own home as extra security, reduces the deposit you need but puts your parents' property on the line if repayments go badly.

On top of that, there is the family home guarantee scheme backed by the government, which is different from private family guarantees through banks. Under that program, eligible single parents with at least one child can buy with a deposit as low as 2 percent, with the government, not the parents, providing the extra security to the lender. This can be life changing for a single buyer who is juggling rent, childcare and a tight income, but it must still pass normal lending checks.

Here is a simple family example. Imagine a buyer with $20,000 saved who wants to purchase a $500,000 unit. Their 4 percent savings fall short of even a 5 percent deposit. If parents gift $10,000, the buyer now has a full 6 percent deposit, which might pair well with a low deposit program. If instead parents provide a guarantee based on equity in their own home, the buyer might contribute only their $20,000 savings but avoid LMI altogether. Both paths can work, yet each has different risks for Mum, Dad and the buyer.

Checklist for talking with parents about help

- Decide together whether support will be a gift, a loan or a guarantee, and write that down in plain language.

- Ask your lender or broker to explain how a loan or guarantee from parents will affect your borrowing power.

- Talk through what happens if you separate from a partner or your income drops, before anyone signs documents.

- Make sure parents have their own advice about how support affects their future plans, retirement and risk levels.

What this means for Buyers

- You can boost your deposit and avoid extra costs, but you should not rely on family help without a clear plan.

- Choosing between a gift, a loan and a guarantee changes how lenders view your application.

- Written agreements and open conversations protect both your family relationships and your home ownership goals.

What this means for Current borrowers

- If you already own a home and want to help your kids, understand how guarantees or gifts fit with your own loan and retirement goals.

- Consider whether partial help, such as a smaller gift or shared saving plan, is safer than backing the whole deposit.

- Review your own loan structure and budget before you become the safety net for someone else's mortgage.

Quick Q&A

Q: Is it better for parents to gift money or go guarantor?

A: A gift is usually simpler and keeps parents' home out of the loan. A guarantee can reduce or remove LMI, but it ties parents' property to your mortgage. The right choice depends on your deposit, your income and how comfortable everyone feels with the risk.

Q: Could family help stop me getting a loan?

A: It can, if the help is structured as a big extra loan that squeezes your budget. Lenders want to see that buying your first house still leaves room for everyday costs and interest rate changes. Clear paperwork and a realistic budget make it easier for them to say yes.

Return to topDisclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.

Written By

The Craggle Team