Home Of Fair Facts & Tips

Renovation Loan: Smarter Summer Upgrades

Renovation loan options explained. See how to fund summer upgrades with equity, top ups, green loans, and rebates. Understand what you need to prepare.

Planning a summer home make-over starts now in Australia. This guide explains the upgrades that give strong value and how to fund them using a renovation loan, redraw, a top up, a refinance, a line of credit or a green loan. It also summarises national and state incentives for solar, batteries and efficient cooling so you can combine discounts with smart finance. All examples are illustrative and use clear Australian numbers.

Key takeaways

- Combine finance and rebates to reduce upfront costs for solar, batteries and efficient cooling.

- Pick the funding tool that matches your goal: redraw for small jobs, top up or refinance for bigger upgrades.

- National battery discounts of around 30% start 1 July 2025 (updated 7 October 2025).

- Victoria offers up to $1,400 PV rebate plus an interest-free loan, and NSW provides upfront cooling discounts.

Summer upgrades that pay back

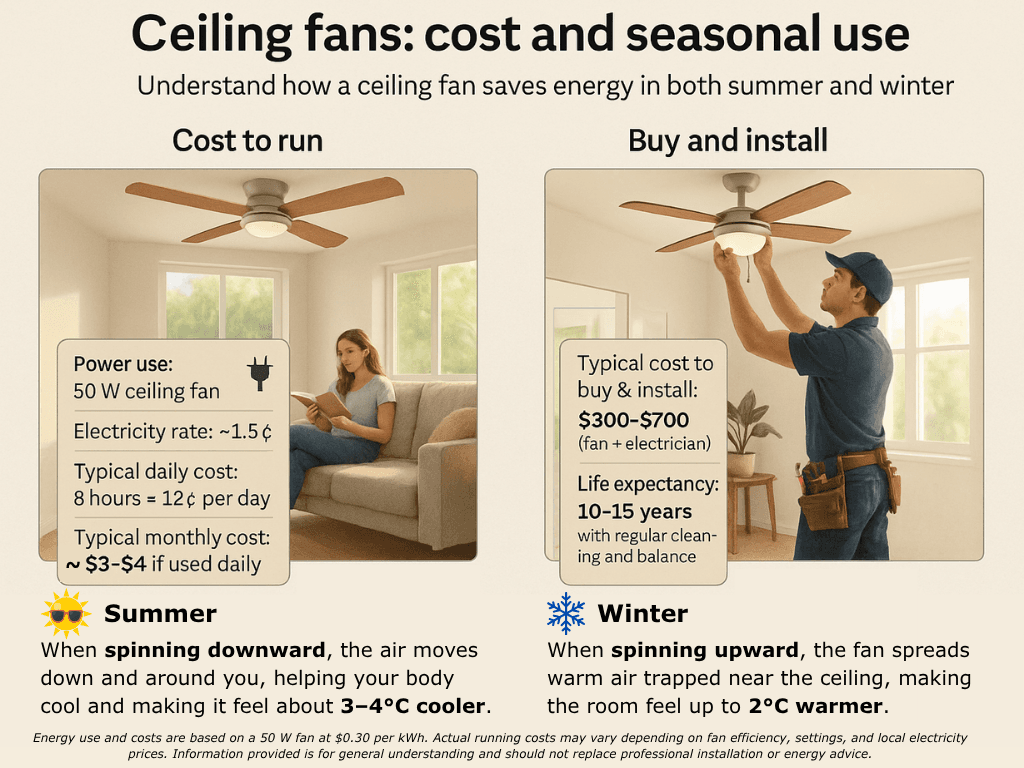

Some upgrades lower bills and lift comfort fast. Solar PV reduces daytime grid use. A high-efficiency split-system keeps summer cool and handles winter heating. Ceiling insulation holds the temperature you paid for. Batteries can stretch solar energy into the evening. The trick is pairing the right upgrade with the right finance and any available rebates. Use clear numbers to plan a sequence you can afford.

Here is a simple table-style list of typical upfront costs and indicative payback notes in Australia. Figures vary by home size, brand and installer, so treat them as directional anchors:

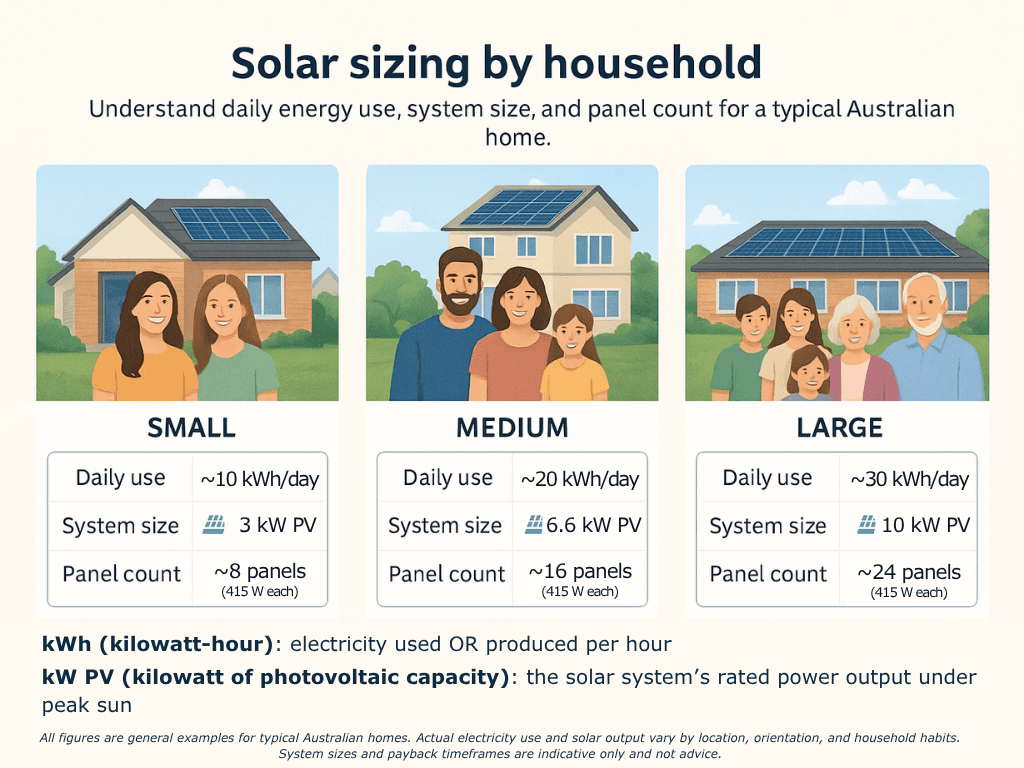

Solar PV: typical 6.6 kW system ≈ $6,500; annual bill saving can exceed $1,000 where self-consumption is high; payback often 4–6 years.

Battery: typical 10 kWh ≈ $10,000 before discounts; with a 30% national discount from 1 July 2025, net ≈ $7,000; payback depends on usage profile and tariffs.

Efficient split-system (≈6 kW): installed ≈ $3,000; NSW incentives can reduce cost further; savings show in both cooling and heating seasons.

Ceiling insulation: installed for a typical home ≈ $2,500; comfort improves immediately; payback often 2–5 years depending on climate.

Worked bundle example: a $15,000 summer plan covering a 6.6 kW PV system ($6,500), a 6 kW split-system ($3,000), ceiling insulation ($2,500) and deck shading ($3,000). With a renovation loan at an illustrative 6.2% and a 5-year term, monthly repayments are about $291. If PV and efficiency measures cut bills by ~$150 per month, the out-of-pocket cost falls to ~$141 during the term. Adjust to your usage, tariff and location.

Solar PV payback in practice

Solar works when much of your generation is used on-site. Time appliances for sunny hours and add smart timers for hot water or pool pumps. A 6.6 kW system producing 9,500 kWh per year with 40% self-consumption might avoid buying 3,800 kWh. At 30 c/kWh, that is a $1,140 annual reduction before feed-in credits.

- Pro tip: compare quotes with identical kW, inverter brand and warranties; confirm DNSP export limits; check product is on approved lists; consider shading.

- What to prepare: recent bills, meter type, roof photos, switchboard photo, preferred install dates.

- Worked example: if your bill is $2,200 per year and PV saves $1,100, simple payback on $6,500 is just under 6 years.

Battery add-on benefits

Batteries shift solar energy into peak times and add backup on some systems. Value improves with evening loads like cooking and cooling. When assessing, look at usable kWh, round-trip efficiency and warranty throughput. From 1 July 2025, a national discount of around 30% applies to small-scale batteries, delivered through the SRES framework (updated 7 October 2025).

- Pro tip: match battery size to evening load; ask for warranty in MWh; check VPP compatibility; confirm accredited installer; get two quotes.

- Worked example: 10 kWh list $10,000, discount ~$3,000, net ~$7,000; if you shift 6 kWh daily at a 25 c/kWh spread, annual saving ≈ $548 plus resilience value.

Efficient cooling that also heats cheaply

A modern high-star split-system can be more efficient than older units for both summer cooling and winter heating. Sizing matters: oversize and it short cycles, undersize and it labours. Look for high seasonal efficiency (SEER/SCOP) and quiet operation that suits bedrooms or living areas.

- Pro tip: compare total installed quotes, not just unit price; review warranty terms; consider location for airflow and noise; check electrical capacity at switchboard.

- Worked example: installed cost $3,000; if it replaces portable cooling and inefficient heating, annual energy savings might exceed $250 to $400 in a typical home.

Ceiling insulation for all-day comfort

Insulation keeps heat out in summer and in during winter. Ceiling first, then draught proofing around doors and downlights. Check existing batts and top up to the recommended R-value for your climate zone.

- Pro tip: ask for documented R-values; verify safe clearances around downlights; consider roof ventilation; keep receipts for potential scheme eligibility.

- Worked example: $2,500 outlay cutting heating and cooling energy by 15% could reduce annual bills by $300 to $450 depending on usage.

Helpful checklist

- List comfort goals, then match upgrades to those goals.

- Collect bills and note summer peaks and evening loads.

- Seek two to three like-for-like quotes per upgrade.

- Plan finance and rebates before you book installs.

What this means for Current borrowers

- Bundle jobs to limit repeat call-outs and rework.

- Use equity or redraw for durable upgrades that lower bills.

- Add approved products to stay rebate-eligible and protect warranties.

Quick Q&A

Q: Do batteries make sense without solar?

A: Most households see best value when a battery pairs with solar to store daytime generation for evening use.

Q: Should I install solar or insulation first?

A: Insulation improves comfort in every season and helps any cooling or heating run less, so many homes tackle it early.

Related reading: Equity and renovation finance basics

- Refinancing to Release Equity: Your Home as a Finance Tool

- How your Loan-to-Value Ratio Impacts What You Pay

- Understanding Home Loan Refinancing: A Comprehensive Guide

Ways to fund your renovation

There is no single best way to finance a project. Match the size and life of the upgrade to the funding tool. Short-lived items can suit redraw. Bigger, durable upgrades often fit a home loan top up or refinance. A line of credit can manage staged works. Green loans may add a discount when the work meets program rules under the Small-scale Renewable Energy Scheme.

Use this structure to compare five common options in Australia: home loan top up, redraw, line of credit, refinance to access equity, and green loan. The aim is to reach a clear cost-per-month figure, then weigh flexibility and fees. Keep documents handy and check whether your LVR improves after valuations, because that can sharpen pricing.

Illustrative anchor: a $30,000 summer upgrade budget for PV, efficient cooling and insulation. At an example 6.2% over 5 years on a principal and interest structure, monthly repayments are about $583. If a green loan discount reduces the rate by 0.5%, repayment falls by roughly $13 per month. Numbers will vary by lender and borrower profile.

Home loan top up (increase)

A top up increases your existing loan limit and adds the funds to your home loan balance. It keeps one lender and one set of features. For durable upgrades that add value or reduce bills, this can be a simple fit. Costs include any variation fee and the interest on the higher balance.

- Pro tip: ask for like-for-like pricing with your improved LVR; confirm whether a new valuation is needed; verify redraw availability after the top up; check break costs if on a fixed rate.

- What to prepare: income documents, statements, planned spend, quotes and expected timeline.

- Worked example: adding $20,000 at 6.2% to a $500,000 loan for 25 years increases repayments by about $132 per month.

Redraw for improvements

If you have paid extra into your loan, redraw lets you use that surplus. There is no new credit assessment, but limits and fees vary by lender and product. It suits small projects that can be paid in one go.

- Pro tip: check daily redraw limits and processing times; confirm any fee per redraw; keep enough buffer for bills; track redraw impact on your term.

- Worked example: using $8,000 of redraw avoids new interest on that amount, but your balance rises by $8,000 after the transfer, so repayments move accordingly.

Line of credit for staged works

A line of credit gives a reusable limit linked to your home. Interest usually applies to what you draw. It can help when work happens in stages or when you want flexibility with trades. Discipline is key: stick to a draw schedule and track total spend.

- Pro tip: confirm the interest type and review periods; set automatic payments above the interest-only minimum; keep a simple spreadsheet of draws; diarise a date to convert balance to principal and interest.

- Worked example: a $40,000 limit drawn in three parts at an example 6.6% interest-only costs about $220 per month per $40,000 fully drawn; cost is lower while partly drawn.

Refinance to access equity

Refinancing replaces your existing loan with a new loan and can release equity for your project. It may change your rate and features. Weigh any discharge and application fees against bill savings and the benefit of funded upgrades.

- Pro tip: get a valuation upfront; compare comparison rates and product features; include discharge, application and settlement fees in your calculation; ask about cash-out policy limits.

- Worked example: refinance a $540,000 loan on a $900,000 home to 70% LVR at a sharper rate and release $90,000 for a full electrification plan.

Green loan (discounted finance)

Some lenders offer discounted pricing when the work meets program rules for solar, batteries or efficiency. Discounts can pair with national incentives delivered via the SRES. Check eligible products and installer accreditation.

- Pro tip: get eligibility in writing; confirm whether the discount is time-limited; store invoices and product datasheets; ask if the discount applies to batteries paired later.

- Worked example: a 0.5% discount on a $25,000 loan over 5 years saves roughly $430 in interest over the term compared with the non-discounted rate, all else equal.

Checklist

- Decide single draw vs staged draws.

- Collect quotes, valuation and loan statements.

- Compare true cost: rate, fees, features and LVR impact.

- Pick a product that matches project life and size.

What this means for Sellers

- Upgrades that cut bills and lift comfort can support buyer appeal in summer inspections.

- Keep receipts and warranty packs for the sales folder.

- Clear, compliant installations reduce deal friction and questions.

Quick Q&A

Q: Is a personal loan ever better than a top up?

A: For small amounts and short terms, a personal loan can avoid touching your home loan, but rates are usually higher. Compare total cost and flexibility.

Q: Does a line of credit hurt discipline?

A: It can if unmanaged. Set a firm draw limit, track each invoice and convert to principal and interest on a set date.

Related reading: Repayments and rates

- How To Find Best Mortgage Refinance Rates

- How Home Loan Interest is Calculated

- Can I Refinance My Home Loan?

Solar and batteries: national incentives 2025

The Australian Government supports small-scale batteries from 1 July 2025 through a discount delivered under the SRES framework. The Department of Climate Change, Energy, the Environment and Water notes: “Australian households, businesses and community organisations can now get a discount of around 30% on the upfront cost of installing small-scale battery systems (5 kWh to 100 kWh).”* Include the page date when citing program settings: (updated 7 October 2025).

How it works in practice: the discount is generally provided through accredited retailers and installers at the point of sale. The value relates to usable capacity and the number of SRES certificates. The scheme is national and can complement state programs where compatible. Eligibility rests on regulations and approved product lists that protect consumers and support safety.

Illustrative example: a 10 kWh battery listed at $10,000 receives an indicative 30% discount of $3,000, netting $7,000. If the battery shifts 6 kWh daily from solar or off-peak into peak times with a 25 c/kWh spread, bill reduction is around $548 per year. Value can improve with higher spreads, VPP income or bill protections, and will vary by household load shape.

National battery discount details

The national discount is designed to lower upfront costs and increase evening self-consumption. Most households will see the discount as a reduced price on the invoice, rather than creating certificates themselves.

- Pro tip: ask retailers to show the discount line clearly; confirm accreditation and approved product lists; weigh peak tariff spread and evening use; check VPP options.

- Worked example: if your evening self-consumption averages 5 kWh and your peak spread is 30 c/kWh, an annual saving of ~$550 to $600 is plausible before VPP income.

SRES framework at a glance

The SRES is an existing scheme that now supports batteries alongside small-scale solar. It relies on product standards, installer accreditation and inspections that have underpinned rooftop PV uptake. This structure helps maintain safety and consumer protections while scaling battery adoption.

- Pro tip: keep copies of invoices and datasheets; ask for warranty throughput in MWh; check grid connection requirements; confirm any export constraints.

- Worked example: a 7 kWh unit at $7,500 with a 30% discount reduces to $5,250; if it time-shifts 4 kWh per day at a 22 c/kWh spread, annual bill reduction is ~$321.

Checklist

- Verify dates and eligibility on the official page (not just the quote).

- Confirm installer accreditation and approved products.

- Ask for simple payback and bill impact estimates based on your usage.

- Keep documents for warranty and scheme audits.

What this means for Current borrowers

- Plan finance to settle close to install so you are not paying interest earlier than needed.

- Bundle PV and battery to reduce scaffolding and travel costs.

- Consider a green loan rate discount if offered.

Quick Q&A

Q: Can the national discount stack with a state rebate?

A: Some programs can stack, but check each scheme’s rules. Ask the installer to show the calculation in the quote.

Q: Do I need to claim certificates myself?

A: Usually the retailer handles it as an upfront discount. You can ask to see how it is calculated.

Victoria: Solar PV rebate snapshot

Victoria offers a Solar Homes PV rebate plus an optional interest-free loan to eligible households. The program page states: “Solar panel rebates plus the option of an interest-free loan are available for eligible Victorian homes.”** Include the page date when using these settings: (Last updated 10 November 2025).

Key figures: rebate up to $1,400 and an optional interest-free loan up to $1,400. Solar Victoria notes monthly repayments for a $1,400 loan are $29.16 over 4 years. More rebates are released each month, and eligibility includes income and property value criteria alongside authorised retailers and eligible products.

Example for planning: a 6.6 kW PV system quoted at $6,500 with a $1,400 rebate and a $1,400 interest-free loan leaves $3,700 to pay at installation. If you use a top up for $3,700 at an example 6.2% over 5 years, monthly repayments are roughly $72, while bill savings can offset a material portion of that cost when self-consumption is high.

Applying step by step

Check eligibility, secure a written quote from an authorised retailer, and wait for Solar Victoria to confirm your eligibility before installation. Use the provided QR code on install day and keep within the installation window.

- Pro tips (VIC): avoid paying a non-refundable deposit before eligibility approval; confirm DNSP pre-approval; keep timelines in mind for builds under construction.

- Worked example: if a household saves $1,000 per year after PV and shifts daytime usage, simple payback on the post-rebate customer cost can sit near 3–4 years.

Checklist

- Confirm eligibility and documents before booking installation.

- Use an authorised retailer and eligible products list.

- Track timelines: 120 days for existing homes, 270 days for homes under construction.

- Keep receipts and QR code evidence for records.

Quick Q&A

Q: Can I apply during construction?

A: Yes, you can apply while under construction and follow the program steps for timing and access.

Q: Can I combine the interest-free loan with other finance?

A: Yes. Many households use the interest-free loan and cover any remainder with savings, redraw or a top up.

NSW: Efficient cooling upgrades

NSW provides upfront discounts through accredited providers for installing efficient air conditioners. The program page clarifies: “Unlike a rebate, this incentive is provided as an upfront discount in the quote provided to you for the installation of a new air conditioner.”*** Always include the page date for settings and amounts: (updated 29 August 2025).

Indicative figures: up to $550 for installing a new 6 kW system, and up to $560 for replacing an old unit with a new 6 kW split-system. Actual discounts depend on the model, installation complexity and provider costs. Consumers are encouraged to compare multiple quotes and check eligibility, product lists and provider accreditation.

Practical example for summer: a family installs a 6 kW split-system quoted at $3,000. With a $550 discount, the upfront falls to $2,450. If the new unit delivers 300 kWh less use over summer at 30 c/kWh and replaces less efficient winter heating later, annual bill reduction could exceed $200 to $350, usage dependent.

Choosing and installing

Get multiple quotes from installers offering the NSW incentive and confirm the discount is included in the written quote. Ask for the seasonal efficiency figures and warranty, and make sure the installer is licensed and the provider is accredited.

- Pro tips (NSW): check eligibility for your address; confirm the unit is right-sized; ask about noise and outdoor unit placement; get final invoice showing the discount line.

- Worked example: replacing an old 5 kW system with a new 6 kW split may qualify for the replacement discount and improve winter heating efficiency as well.

Checklist

- Gather two to three quotes from providers offering the incentive.

- Confirm eligibility and required paperwork before installation.

- Request written warranty and commissioning details.

- Keep before-and-after photos and invoices.

Quick Q&A

Q: Can renters access this incentive?

A: Speak with the property owner first. The program requires the installing party to meet eligibility rules and paperwork.

Q: Are all models eligible?

A: No. Eligibility varies by model and size. Ask the installer to confirm the model is approved for the incentive.

Equity and borrowing basics for owners and investors

Equity is the difference between your property value and your loan balance. Lenders often cap new lending at a specific LVR, commonly 80% without lenders mortgage insurance. Accessible equity is the amount up to that cap after subtracting your existing loan. Use this as a planning tool for renovation budgets, keeping fees and buffers in mind.

Owner-occupier example: property value $900,000, loan $540,000. At an 80% LVR cap, the cap amount is $720,000. Accessible equity before fees is roughly $180,000. That can fund a major solar, battery and efficiency program or a staged renovation plan that lowers bills and improves comfort.

Investor example: investment property value $800,000, loan $480,000. At a 70% target LVR for risk management, the cap amount is $560,000 and accessible equity before fees is about $80,000. An investor might deploy this for efficiency upgrades that improve renter comfort and potentially reduce vacancy risk, subject to tenancy laws and approvals.

Understanding LVR and pricing

Lenders price by perceived risk and LVR bands. Moving from 85% to 80% or 80% to 70% can produce sharper pricing or better features. Renovations that lift value may lower LVR and improve offers. Valuations can differ, so compare lender approaches and recent comparable sales.

- Pro tip: request valuation early; compare like-for-like features; include fees in your sums; test a shorter term for smaller drawdowns.

- Worked example: if a renovation raises a home from $900,000 to $945,000, the 80% cap increases by $36,000, potentially unlocking more equity at the same LVR.

Structuring the debt

Consider keeping renovation funds in a separate split. This can aid tracking and make extra repayments easier to target. When the upgrade is complete, review rates and features again, because the home’s value and your LVR may have changed.

- Pro tip: use a dedicated split; set up automatic extra repayments; keep a cash buffer; recheck pricing every 12 months.

- Worked example: a $25,000 split over 5 years at 6.2% has repayments near $487 per month; after the term ends, the split is cleared while the main loan continues.

Checklist

- Calculate accessible equity and target LVR before you seek quotes.

- Decide on redraw, top up, refinance or a line of credit.

- Set budget, timeline and repayment plan with buffers.

- Revalue after completion to reassess pricing.

Quick Q&A

Q: Can I use investment property equity for my own home’s upgrades?

A: Some lenders permit cross-collateralisation or separate secured splits. Policies vary. Keep clear records of purpose and interest.

Q: How much equity do I need for a small upgrade?

A: For a $12,000 project at 80% LVR, accessible equity needs to cover the amount plus fees. A small top up or redraw may be enough.

Sources

* Cheaper Home Batteries Program: Department of Climate Change, Energy, the Environment and Water; 2025

** Solar panel (PV) rebate: Solar Victoria; 2025

*** Upgrade your air conditioner: NSW Climate and Energy Action; 2025

Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.

Written By

The Craggle Team