Home Of Fair Facts & Tips

Is Refinancing Worth It For You?

Find out how refinance a home loan can cut repayments. See how rates, fees and features change savings, and learn practical steps to compare options in Australia.

Refinancing can shrink your mortgage repayments and interest over time. Many Australians have not checked whether switching could help, even after a few years with the same lender. This guide explains how to size up your rate, compare options, and understand real switching costs. You will find plain-English steps, worked examples, and quick checklists for Australia.

Key takeaways

- Small rate gaps add up: even a 0.25% to 0.50% difference can change yearly costs meaningfully.

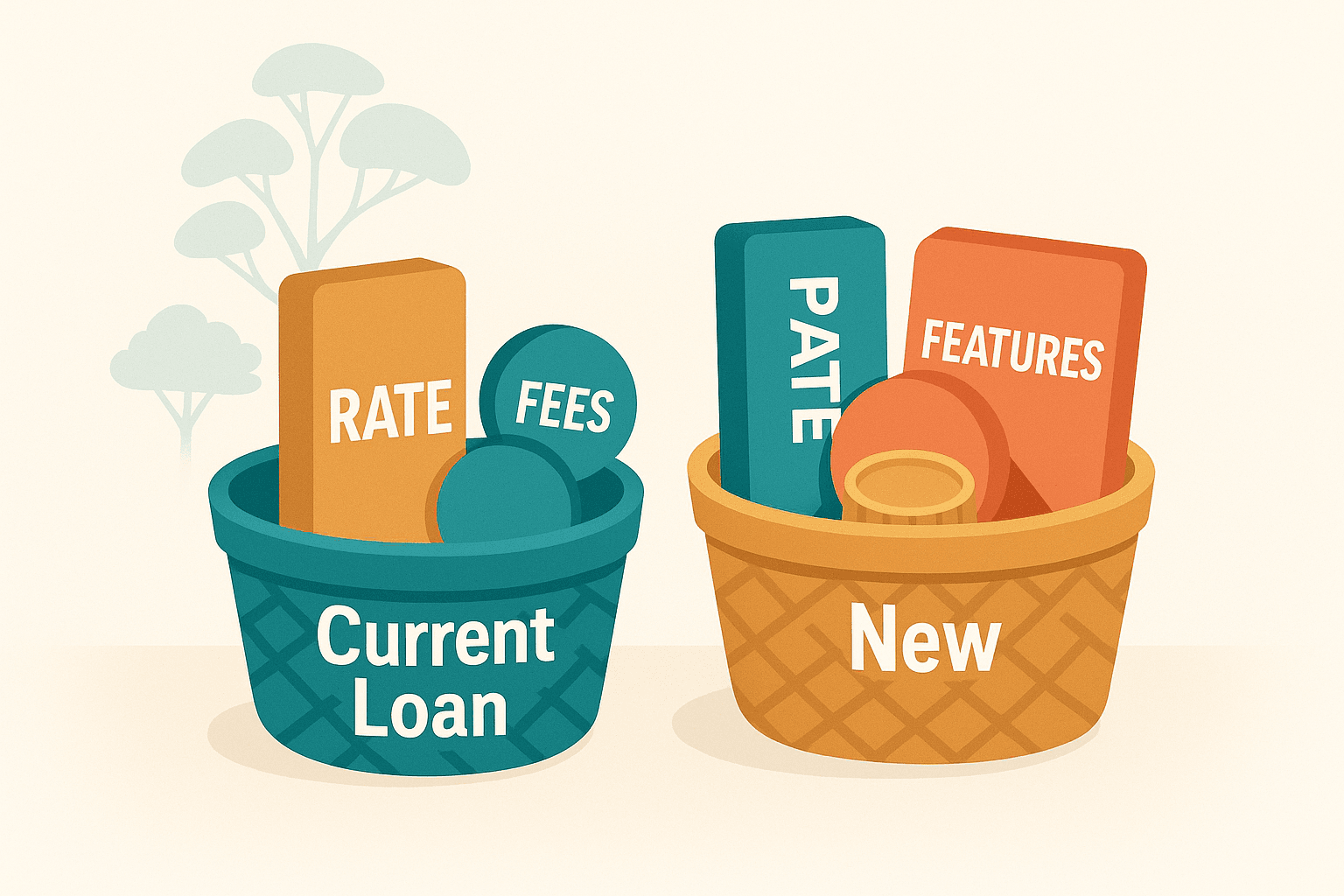

- Check your current rate, comparison rate, fees and features before you switch.

- Three common levers: ask for a discount, refinance to a lower rate, or optimise your setup with an offset account or split.

- Map the true switching cost and timeline so savings are real, not just on paper.

Refinance After 3 Years: Where To Start

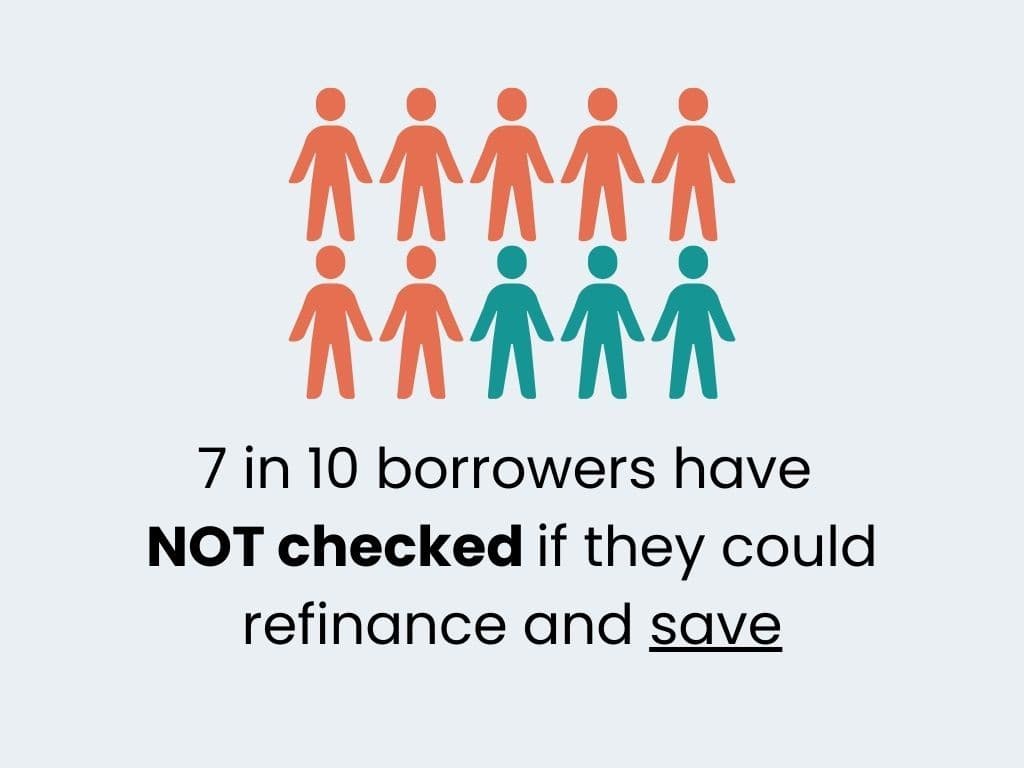

Plenty of homeowners keep the same loan for years and never check the rate. Survey findings show a large share of borrowers with mortgages for 3 or more years have not refinanced in that time, even though lenders often give new customers sharper deals. Start by confirming your current interest rate and the comparison rate, because the comparison rate bakes in standard fees and gives a truer like-for-like view.

Look for gaps between what you pay and what new customers get. As one expert put it: “There can be a 0.50% difference between some of the advertised rates on Compare the Market’s home loans panel so you can effectively create your own rate cut by shopping around.”* A half-percent sounds small, yet it can change monthly cash flow and total interest over years.

Next, check your loan-to-value ratio (LVR). If your property has grown in value or your balance has dropped, a lower LVR band may unlock better pricing. Review features too: an offset account, redraw access, and repayment flexibility. Finally, list any exit and setup fees to understand the true switching cost.

Example: A $600,000 owner-occupied loan over 30 years at 6.2% has repayments near $3,690 per month. If you moved to 5.7%, the monthly falls to roughly $3,478. That is about $212 a month, or $2,544 a year, before fees. If switching costs are $700 all up, the breakeven time is a little over three months.

Find your current rate and comparison rate

Grab your latest statement or online dashboard and note your rate type, current interest rate, and the comparison rate. Comparison rates help you compare different loans with typical fees included. Check whether your product has changed since settlement, and whether a revert rate applied after a fixed period.

- Pro tips: Ask your lender for your current rate in writing, and the product’s comparison rate; confirm any package fee.

- Record your remaining term and balance; repayments differ with term length.

- Check if your rate is a revert rate after a fixed term ended.

- Worked example: If two loans both say 5.8% but one has a $395 annual fee, the comparison rate will usually be higher on the fee-paying loan.

- Template phrase: “Please confirm my current interest rate, the comparison rate, and any package or ongoing fees on my home loan.”

Check your LVR and property value

LVR bands matter for pricing. A move from, say, 86% to 79% can open sharper rates with many lenders. Use a recent estimate or a lender-ordered valuation to confirm your current LVR. Lower LVR usually equals stronger eligibility for discounts, especially when combined with clean repayment history.

- Pro tips: Keep rates “like-for-like” on purpose, occupancy and LVR when comparing.

- Point to improvements: extra repayments or value growth can shift your band.

- Worked example: On a $700,000 property with a $525,000 balance, LVR is 75% which may qualify for better pricing than an 85% LVR.

Estimate true switching cost

Map every fee: discharge fee, registration fee, settlement agent fee, and any new-lender setup fee. If you are on a fixed rate, ask about break costs. Add government or title fees if applicable. Subtract any cashback or fee waivers to estimate your net cost and breakeven months.

- Pro tips: List fees line by line and confirm in writing before you switch.

- Do not rely on headline rates without the comparison rate.

- Worked example: If you save $180 per month and pay $600 to switch, breakeven is just over 3 months; after that, savings are pure gain.

Helpful checklist

- Confirm current rate and comparison rate

- Check LVR and property value estimate

- Collect fee schedule and compute breakeven months

- Decide on features you will use: offset, split, redraw

What this means for Current borrowers

- A lower LVR or long on-time history can support sharper pricing.

- Even a 0.25% gap can be meaningful on six-figure balances.

- Knowing your comparison rate helps avoid false savings.

Quick Q&A

Q: How often should I review my rate?

A: A quick check every 6 to 12 months helps you spot gaps early.

Q: Does an offset account always win?

A: Offset benefits depend on the cash you keep in the account and any package fees. Compare the comparison rate and your likely offset balance.

Related reading: Refinancing basics and rate checks

- Can I Refinance My Home Loan?

- What is the Comparison Rate? Unveiling Its Impact on Home Loans

- Unlock Australia's Top Refinance Mortgage Rates

Three Ways To Cut Repayments Today

There are three common levers: ask for a discount, refinance home loan to a lower comparison rate, or adjust how your loan is set up. You can mix and match: try a pricing review first, then refinance if the gap remains. As one expert said, “We can’t rely on the Reserve Bank to deliver mortgage relief.”* That means action you control can matter more than headlines.

Start by benchmarking your rate against current new-customer offers at a similar LVR and purpose. If your lender will not match a market-leading offer, consider switching. Also weigh features like an offset account and repayment flexibility, which can boost savings even if the headline rate is similar.

Example: On a $750,000 balance over 30 years, cutting from 6.3% to 5.8% saves roughly $247 per month or about $2,964 per year. If your net switching cost is $900, breakeven is under 4 months. Add an offset balance of $20,000 and you could shave extra interest each month.

Ask your lender for a discount

Pricing reviews are quick and can deliver an immediate cut without paperwork. Mention your LVR improvement and competing like-for-like rates. If your lender values retention, a sharper discount may land within days.

- Pro tips: Compare rates at your LVR band; quote specific offers.

- Template phrase: “Could you assess a pricing discount based on my current LVR and market rates for new customers on similar products?”

- Worked example: A 0.20% discount on $700,000 saves about $92 per month.

Refinance to a lower comparison rate

When the gap stays wide, refinancing can reset your price and features. Use the comparison rate to compare like-for-like, then factor setup and government fees. Consider a redraw or offset to keep flexibility for future plans.

- Pro tips : Ask lenders to confirm fees and any cashback timing in writing.

- Check policy fit: employment, income types, and credit score signals.

- Worked example: If your comparison rate falls by 0.45% on a $500,000 balance, interest saved can be around $2,200 in year one before fees.

Optimise your setup with offset or split

An offset account can lower interest by reducing the balance used to calculate interest. A split loan lets you fix part for certainty and keep a variable part for flexibility and extra repayments.

- Pro tips : Offset works best if you hold steady cash in the account.

- Fixed portions often limit extra repayments; check caps and redraw rules.

- Worked example: With $25,000 parked in offset on a 6.0% variable rate, you avoid roughly $1,500 of interest over a year, before tax effects.

Checklist

- Run a pricing review with your current lender

- Benchmark like-for-like rates and comparison rates

- Decide on features: offset, redraw, split

- Confirm fees and calculate breakeven months

What this means for Current borrowers

- You control speed: a discount can arrive faster than a full refinance.

- Refinancing can add features and a sharper rate together.

- Offset and split setups can add resilience without overpaying for features you do not use.

Quick Q&A

Q: Should I try a pricing review before switching?

A: Yes, it is quick and can set a baseline. If the gap stays wide, compare refinance offers from banks and non-banks.

Q: How do cashbacks fit now?

A: Treat cashbacks as a sweetener. Focus on rate, fees and policy fit so savings endure after the first year.

Related reading: Loan features and switching costs

- Redraw vs Offset Account: Which Can Turbocharge Your Mortgage

- Typical Refinance Fees Unveiled: Saving Money on Your Mortgage

- Fixed Vs. Variable Rate Home Loans: Find Out Which is Best

Fixed, Variable or Split When Refinancing

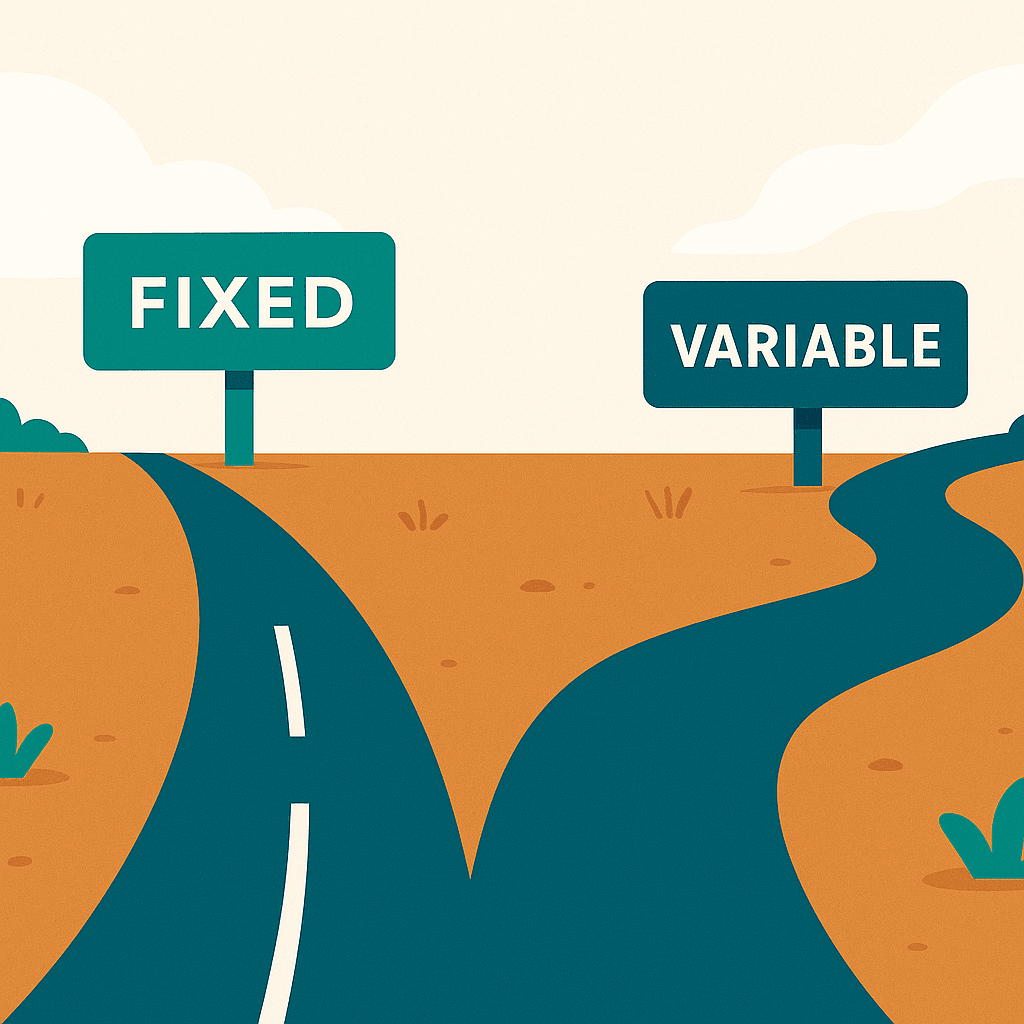

Structure matters as much as price. A fixed rate offers certainty for a period, often with limits on extra repayments and break-cost risks if you end early. A variable rate gives flexibility, full offsets and easier extra repayments, but it can move with the market. A split aims to blend both: some certainty and some freedom to pay extra.

Think about your income stability, savings buffer, and how often you make extra repayments. If you keep a steady cash balance, an offset account on the variable portion can work hard in the background. If you want a set figure for budgeting, fixing a portion can help. Recheck the comparison rate for each option so like-for-like comparisons include typical fees.

Example: Consider a $500,000 refinance over 30 years. Option A: 5.9% variable with full offset. Option B: 5.7% fixed for 2 years with a $395 annual package fee and $10,000 extra repayment cap per year. Option C: 50:50 split at 5.9% variable and 5.7% fixed. If you hold $30,000 in offset, Option A or C could out-save Option B despite the lower fixed headline rate, due to interest avoided by the offset.

When a fixed rate helps

Fixing part of your balance can be useful if you value predictable repayments for a known period. It can be helpful during big life events where certainty is your priority.

- Pro tips : Check extra repayment caps and redraw rules on fixed portions.

- Ask about rate lock fees and how long the lock applies before settlement.

- Worked example: Fixing $250,000 at 5.6% for 2 years can hold repayments steady even if variable rates move during that window.

When a variable rate fits

Variable loans suit extra repayments, full offset and flexibility. They can move down or up with the market. If you actively pay extra or keep savings in offset, the flexibility often pays off.

- Pro tips : Confirm your product allows unlimited extra repayments on the variable portion.

- Check for any monthly or annual fees that lift the comparison rate.

- Worked example: With $20,000 in offset at 6.0%, you avoid about $1,200 interest in a year, even if the headline rate does not change.

Split strategy for stability

A split lets you fix a portion for certainty while keeping the rest variable for flexibility. You can choose the split to match your savings pattern and risk comfort. Some borrowers review the split at each fixed expiry.

- Pro tips: Choose a split that matches your likely offset balance and extra repayments.

- Note that fixed portions may carry break costs if you end early.

- Worked example: A 60:40 variable-to-fixed split on $600,000 keeps $360,000 flexible for extra repayments while locking $240,000 for stability.

Checklist

- Decide the role of certainty vs flexibility

- Compare comparison rates for each structure

- Match split size to your offset balance and extra repayments

- Check fixed extra repayment caps and any rate lock fee

What this means for Buyers

- Choosing structure at refinance can suit a purchase or upgrade plan.

- Offset on the variable portion keeps savings working while you prepare for costs.

- Re-check revert rates and what happens after a fixed term ends.

Quick Q&A

Q: Can I change my split later?

A: Many lenders allow changes at refix or refinance. Mid-term changes can be limited and may carry fees.

Q: Is a lower fixed headline always better?

A: Not always. Compare the comparison rate and your offset benefit across the whole period.

True Cost To Switch: Fees, Timing, Credit

Refinancing works best when you know the end-to-end costs and timeline. Typical line items include a discharge fee from your current lender, government registration and title fees, and the new lender’s application and settlement fees. Break costs can apply if you are on a fixed rate. Balance these against any fee waivers or cashback to see your net cost.

Timelines vary. Many refinances settle in a few weeks once documents are ready. You will usually need identification, recent statements, income documents, property insurance details, and consent for a valuation and credit check. Keep your repayments on time during the switch so your credit profile remains strong.

Example: Suppose your total switching cost is $850, made up of a $350 discharge fee, $200 in government charges and $300 in application and settlement costs. If your new rate trims repayments by $190 per month, your breakeven is under five months. From there, the saving compounds each year.

Switching fees to expect

List every fee up front to avoid surprises and to calculate breakeven time. Ask for a fee sheet in writing from both lenders. Remember to include any package fee and the first year’s annual fee if charged at settlement.

- Pro tips: Confirm whether fixed break costs can apply and how they are calculated.

- Ask whether title registration will be charged by the lender or your conveyancer.

- Worked example: If a $1,000 cashback offsets $750 of fees, your net cost is $250.

Timeline and settlement steps

After approval, your new lender coordinates settlement with your current lender. You will sign discharge and mortgage documents. The valuation and any conditions must be met before booking a settlement date. Keep a buffer for final interest adjustments at payout.

- Pro tips: Keep funds ready for any settlement shortfall due to interest accrual.

- Check whether your salary is redirected to the new offset account from day one.

- Worked example: If your approval lands on the 10th and settlement is on the 24th, two weeks of interest will accrue on the old loan to payout.

Credit score signals and eligibility

Lenders assess credit history, conduct and capacity. Multiple recent applications can be a negative signal if they do not lead to approval. Keep applications focused and provide clear documents the first time.

- Pro tips: Keep your existing repayments perfect through the switch.

- Provide complete statements and payslips to avoid rework.

- Worked example: A clean 24-month repayment history can support sharper pricing than a similar profile with recent missed payments.

Checklist

- Collect ID, income docs, statements and insurance details

- Request fee sheets and calculate breakeven months

- Plan salary redirection and offset setup for day one

- Keep repayments on time until after settlement

Quick Q&A

Q: Will refinancing affect my credit score?

A: An application triggers a credit inquiry. Good conduct and focused applications usually help more than they hurt over time.

Q: How long does refinancing take in Australia?

A: Many cases settle in a few weeks once documents are complete and valuation is back. Complex cases can take longer.

Sources

* ‘Save anyway’: Aussie homeowners urged to seek out better rates as RBA delays relief: Compare the Market; 2025

Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.

Written By

The Craggle Team