Home Of Fair Facts & Tips

Investors are back in the property game

Why investors are returning to the Australian property market, how rate cuts and tight rentals shape the opportunity, and what it means for you.

Investors are stepping back into the Australian housing market as rate cuts, stronger borrowing power and tight rental vacancies create fresh momentum. This article explains what is driving the surge in investment loans, how recent rate moves and price trends change the numbers, and why the rental squeeze matters for long term returns. You will see a simple example of using home equity to buy a rental and a checklist to stress test your own plans. The goal is to help you read the property market with clear eyes and make grounded decisions about your next move.

Key takeaways

- New investment loans have climbed again, helped by lower rates and renewed confidence.

- Rate cuts boost borrowing power, but stretched affordability and high prices still bite.

- Tight rental vacancies and rising rents improve cash flow potential for investors.

- Using home equity to invest can work if you keep buffers and plan for higher rates later.

Why investors are back in force

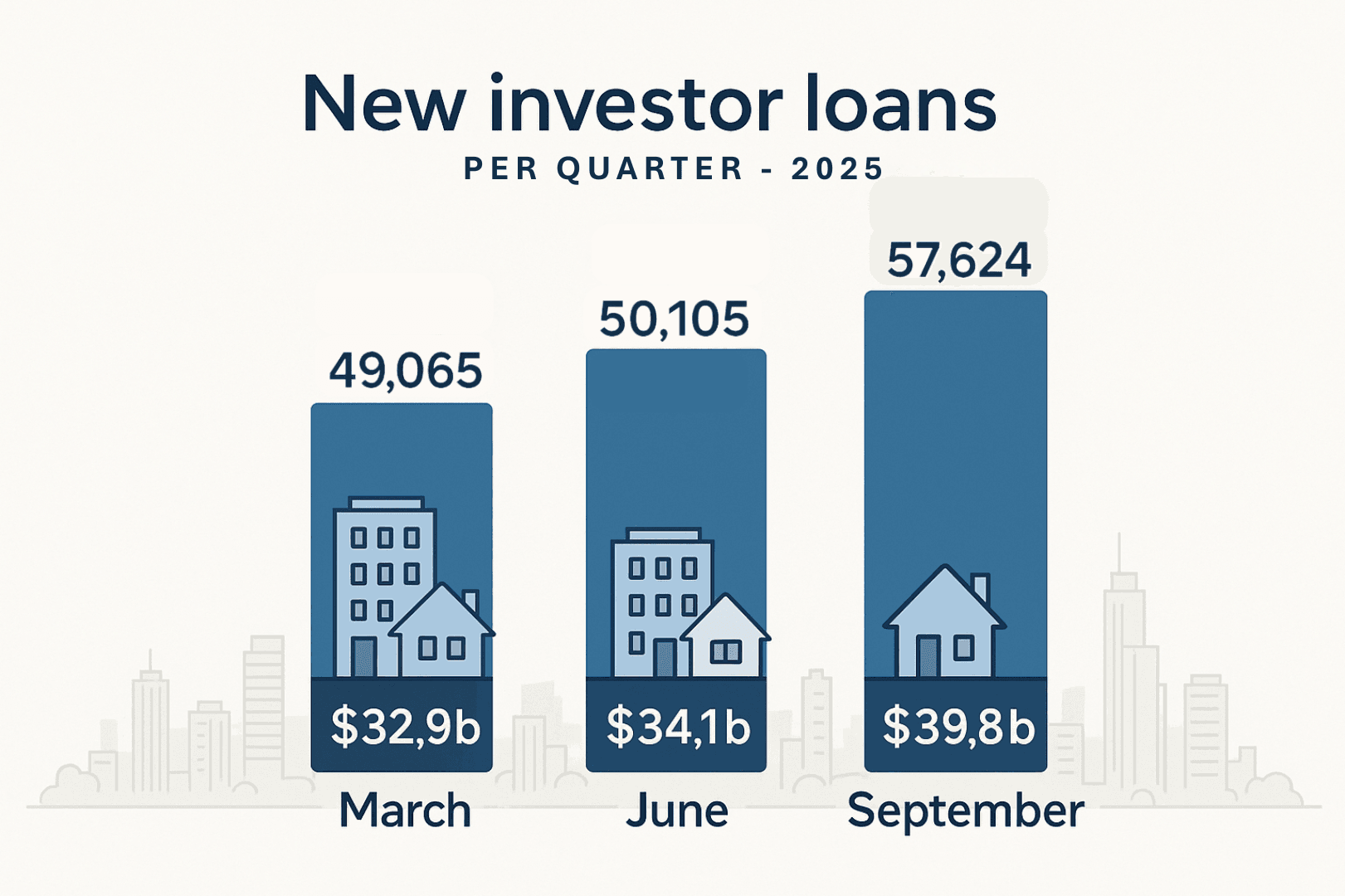

Australian real estate has moved into a new phase where investors are once again a big part of the story. Official lending indicators show that in the June quarter 2025 there were 49,065 new investment loans approved for dwellings, worth about $32.9 billion, after a 3.5 percent rise in loan numbers compared to the previous quarter. A few months later, investor lending stepped up again, with 57,624 new investment loans in the September quarter and the value of those loans rising 17.6 percent to $39.8 billion. While growth is slower than the huge surge seen coming out of the pandemic, the share of investment activity in the australia property market is clearly rising.

Several forces are working together. Rate cuts are one. Commentary from Cotality notes that the Reserve Bank’s third cut in this cycle has been delivered along a cautious easing path, after inflation eased and the unemployment rate drifted higher. The average variable mortgage rate is estimated to have dropped to around 5.5 percent, saving roughly $120 per month on a $750,000 home loan compared with the level before the recent cuts, and about $370 per month compared with January. In plain language, lower repayments mean more borrowing capacity, which is exactly what many property investors have been waiting for.

Related reading: Investment property strategies

- The Investor's Playbook: Refinancing for Property Investment

- Reduce Tax with Negative Gearing: Investment Property Guide

- Building a Portfolio: Investment Property Home Loans Guide

Rental conditions are the other big driver. SQM Research reports that the national vacancy rate fell to 1.2 percent in July 2025, leaving only 37,863 rentals available across the country and keeping landlords in a strong position. Capital city data shows tight conditions in Sydney, Brisbane and Perth, with vacancy rates below about 1.6 percent and advertised rents rising across most markets. When there are few properties available and many tenants looking, rental income feels more reliable, which supports fresh investment.

Online search behaviour tells the same story. People type in simple terms such as “real estate”, “brisbane real estate”, “property market” and “property news” as they look for an overview of what is happening. They then add more detail with phrases like “real estate in melbourne australia”, “real estate in brisbane australia” and “australia property market” when they are narrowing down suburbs and cities. Others search for “australian property prices” and “australia house prices” or click into a domain property price page to see how asking prices compare with a year or two ago. Behind every search is a person trying to decide whether this is the moment to step in or wait.

To see how this can play out, imagine an investor buying a $500,000 unit in a busy inner ring suburb. With a 20 percent deposit of $100,000 and a $400,000 interest only loan at 5.5 percent, annual interest would be about $22,000. If the property rents for $650 per week, that is roughly $33,800 per year in rent. Even after allowing $7,000 for rates, insurance and maintenance, the investor is left with a modest surplus before tax. In markets like Brisbane and Perth, where vacancy rates are under 1 percent and advertised rents have been climbing, the numbers can look even stronger for well chosen properties.

Checklist: signals that investors are returning

- More investment loan approvals and higher total loan values in official data.

- Low rental vacancy rates in your target area and rising advertised rents.

- More investor focused listings and headlines aimed at property investors.

- A noticeable lift in enquiry numbers at open homes and rental inspections.

What this means for Buyers

- Expect more competition at open homes in investor friendly suburbs and price points.

- Be clear on your budget before you look so you are not dragged into a bidding war.

- If you are one of the first home buyers still saving, keep in mind that investor demand can push entry level stock higher.

What this means for Current borrowers

- If you already own a home, rising interest in investment property australia may create chances to use your equity carefully.

- Low rental vacancies mean any future investment is more likely to be tenanted, but you still need cash buffers.

- Watch your total debt level so extra borrowing does not leave your household exposed if conditions change.

Quick Q&A

Q: Does rising investor activity mean the market is about to boom again?

A: Not necessarily. Investor loans are growing, but stretched affordability, tighter lending standards and higher living costs are all acting as a brake. It is more of a grind higher than a runaway boom.

Q: Should I rush to buy before more investors pile in?

A: No. A rushed decision is more dangerous than a delayed one. Focus on your budget, buffers and long term plan first, then act when the numbers work for you.

How rate cuts and prices shape the market

Interest rate moves and price trends are the twin engines of the housing market. When rates rise, borrowing power falls and prices usually soften. When rates fall, the opposite tends to happen. The recent run of cuts has lifted confidence, but Cotality’s analysis reminds us that the cash rate is coming down from a high base and monetary policy is still in fairly restrictive territory compared with the decade before the pandemic.In other words, money is cheaper than it was a year ago, not cheap in absolute terms.

The key concept here is borrowing capacity, which simply means how much a lender is willing to let you borrow based on your income and expenses. With rates lower, the test repayment used in the calculator is smaller, so the maximum loan size can rise. At the same time, banks still apply a buffer above actual rates and check that your budget can handle higher repayments. This is why you might see media talking about “interest rates investment property” but also hear stories about applications being knocked back when spending or other debts look too tight.

Price behaviour is just as important. Many people watch “australian property prices” or “australia house prices” charts to see if values are up or down. In reality, conditions vary widely. Combining lower rates with tight rental supply and limited new construction has supported prices in many capital cities and regional hubs. In some suburbs, investors are bidding against each other for well located townhouses and units. In others, families are the main buyers, and investors need to be more patient.

Search trends show how different groups think about this. Strategy questions like “property investment australia”, “first home buyers” and “first time home buyer grants” sit alongside more technical ideas such as “negative gearing” as people weigh up their next move. These searches reflect the same basic question: will this property help me build wealth over the long term, or will it become a cash drain if rates move again?

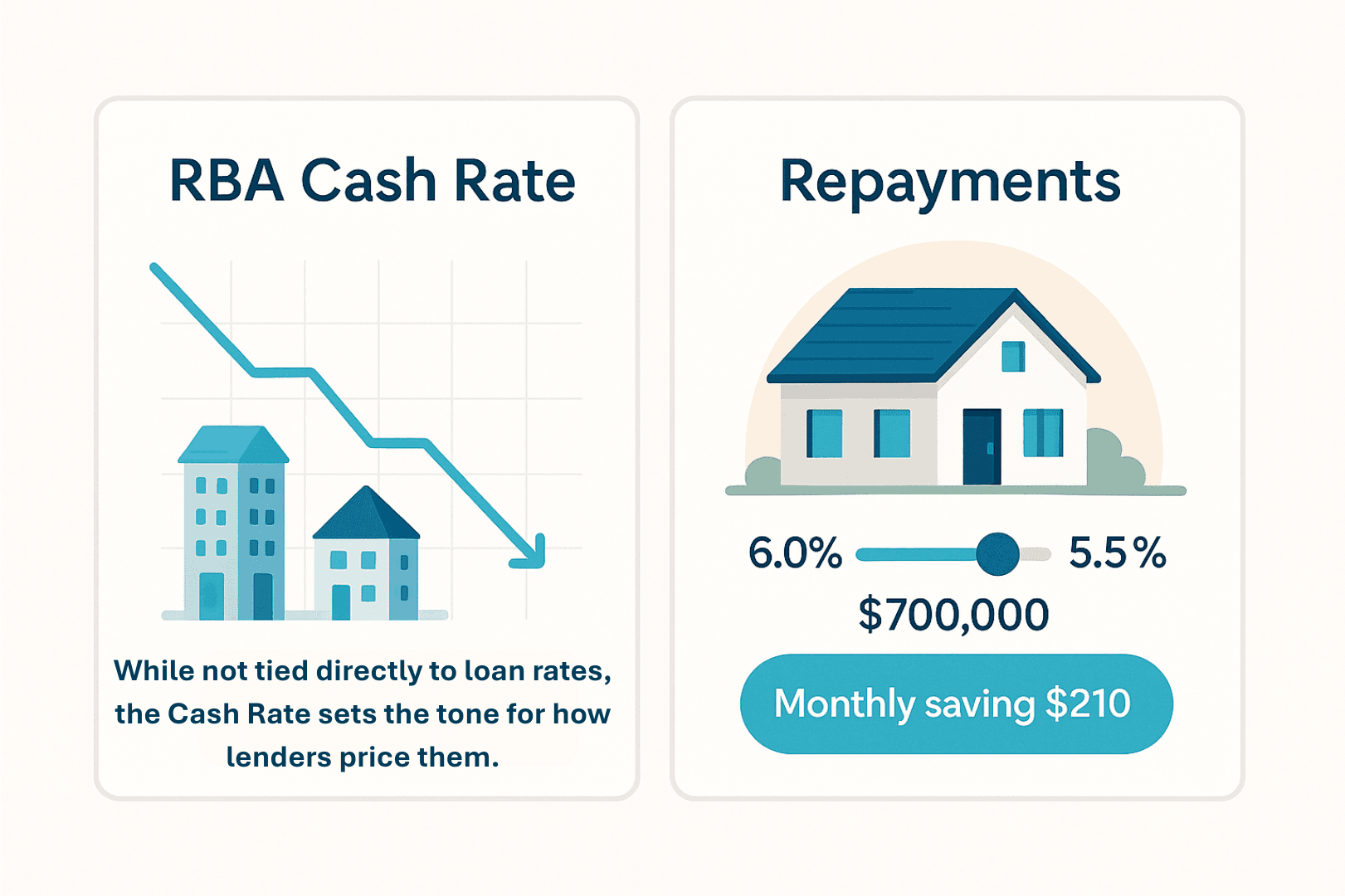

Take a simple example. Say you buy a $700,000 house with a 10 percent deposit of $70,000 and a $630,000 principal and interest loan over 30 years. At a rate of 6.0 percent, repayments are roughly $3,780 per month. If the rate falls to 5.5 percent, repayments drop to about $3,570 per month, a saving of around $210 each month. That saving could go towards extra repayments, a maintenance buffer, or holding costs if the property is vacant for a few weeks. The flip side is that if rates climb again, those savings evaporate quickly, so planning for higher repayments is still essential.

Steps to stress test your numbers

- Model your repayments at a rate 2 to 3 percentage points higher than today.

- Check that you can still handle repayments, bills and everyday spending comfortably.

- Allow for periods of lower rent or a vacant property between tenancies.

- Review your insurance, including landlord cover, to protect cash flow shocks.

What this means for Buyers

- Lower rates can help you borrow more, but that does not mean you should stretch to the limit.

- If you qualify for first time home buyer grants, treat them as a bonus, not a reason to overextend.

- Pay more attention to the quality of the property than to short term rate moves.

What this means for Current borrowers

- Rate cuts are a chance to get ahead by keeping repayments the same and paying down the loan faster.

- You can also consider refinancing if you are on an older, higher rate, but watch the fees and conditions.

- Use the breathing room to build savings so you are ready if rates rise again or your income changes.

Related reading: Market trends and prices

- Rent Vs Buy: Calculate The Difference Here!

- Impact of Low Rates and the Pandemic on House Prices

- Median House Prices and Market Trends

Quick Q&A

Q: Will lower rates always push prices higher?

A: Lower rates often support prices, but they are not the only driver. Supply, wages, population growth and lending rules all matter. That is why some areas surge while others stay flat.

Q: How should I think about risk when investing during a rate cutting cycle?

A: Assume that today’s settings will not last forever. Focus on properties that would still be workable if repayments were a few hundred dollars higher per month and rents slowed down.

Turning home equity into an investment property

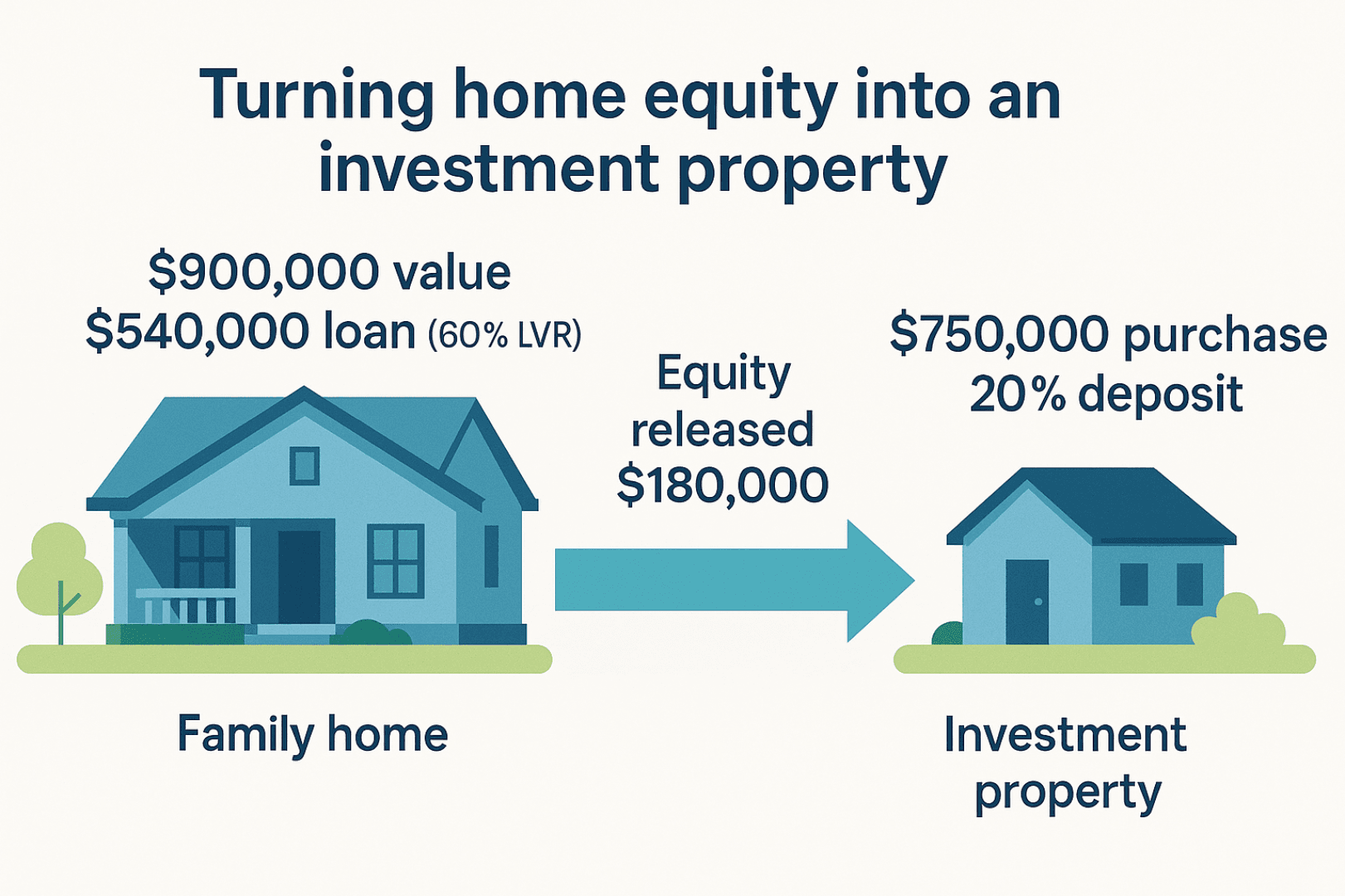

One of the most common questions in this environment is how to use existing home equity to buy a rental. Many owners are keen to join the ranks of property investors but do not want to save a full cash deposit from scratch. The basic idea is simple. If your home has grown in value and your loan has reduced, you may be able to top up the loan or add a separate investment loan secured by your property. The extra funds then become the deposit and costs for a new purchase.

For example, imagine your home is worth $900,000 and your current loan is $540,000. Your loan to value ratio is 60 percent, which is relatively low. If your lender is comfortable with you going up to 80 percent, you might be able to borrow up to $720,000 in total. That leaves room to draw out up to $180,000 in usable equity, which could fund a 20 percent deposit plus costs on a $750,000 investment property. Whether that is wise depends on your income, buffers and goals, not just the equity amount.

At this stage many people start researching “investment property tax deductions”, “capital gains on investment property” and “capital gains tax on property”. They want to know what costs might be deductible, how tax rules treat a future sale and what records they need to keep. Others ask about “investing super in property” and how super funds might be used as part of a long term plan. These are important topics, but the rules are complex and can change, so personalised advice is essential.

A smaller group push further into strategy and search for “property investment australia”, “super funds” and “investing money” as they map out wider wealth plans. Some will use negative gearing, where the rent and other income from an investment property do not fully cover the interest and running costs, creating a loss that may reduce taxable income. Others prefer their investment to at least break even in cash terms. Portals full of property properties and tight rental listings make it tempting to move quickly, but careful planning usually wins in the long run.

Remember that rental markets are tight but not risk free. SQM’s vacancy data shows that across many capital cities advertised rents have risen strongly, with national combined rents around $650 per week and capital city averages over $740. An investment that looks comfortable at today’s rent could become strained if local conditions change, a building needs major work or a tenant falls behind.

Checklist: using equity with care

- Confirm your current home value and loan balance with up to date figures.

- Work out how much equity you could access while staying at or below your preferred loan to value ratio.

- Test the cash flow on the new property using conservative rent and higher rate assumptions.

- Talk to a tax professional about how negative gearing and future capital gains tax on property might affect your overall position.

What this means for Buyers

- If you do not yet own a home, focus on a solid first purchase before thinking about multiple properties.

- Use calculators and simple scenarios to test whether a potential home still works if rates or rents move against you.

- Consider how an eventual upgrade or investment purchase would fit into your wider plan.

What this means for Current borrowers

- Using equity can speed up your investment journey, but it also concentrates your risk into the housing market.

- Set clear rules around minimum cash buffers and maximum total debt before you proceed.

- Review your strategy each year so your property portfolio does not drift away from your original goals.

Quick Q&A

Q: Do I need my home fully paid off before buying an investment property?

A: No. Many investors use equity from a home that still has a loan attached. The key is making sure repayments on both loans plus living costs stay comfortably within your budget.

Q: Is it safe to invest if I am relying on tax benefits to make the numbers work?

A: Relying only on tax benefits is risky. Aim for a property that still makes sense before tax, then treat any tax savings as a bonus rather than the main reason to invest.

Sources

SQM Research, “National Vacancy Rates Fall to 1.2% in July — Rental Squeeze Intensifies”, media release, 12 August 2025.

Cotality, “Rates finally fall, but stretched affordability to keep housing market in check”, commentary, 1 May 2025.

Australian Bureau of Statistics, “Lending indicators, June Quarter 2025” and “Investment loans drive growth in the June quarter”, housing finance statistics and media release.

Australian Bureau of Statistics, “Lending indicators, September Quarter 2025” and “Investment loans reach record high”, housing finance statistics and media release.

Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.

Written By

The Craggle Team