Home Of Fair Facts & Tips

How Fortnightly Payments Cut Your Mortgage

Learn how fortnightly repayments, extra payments and a mortgage calculator payments check can help you pay off your mortgage faster.

This article explains how fortnightly repayments can help you pay off your mortgage faster without turning your budget upside down. You will see how the simple "half the monthly repayment, pay it every fortnight" idea really works in Australia. We walk through clear examples, show how to use online calculators to test your own loan, and outline the trade offs to watch. By the end, you will know how to build a simple, flexible plan that helps you get ahead on your home loan.

Navigate this article

How fortnightly repayments save you money

Using calculators to plan your payoff

Choosing the right repayment strategy

Key takeaways

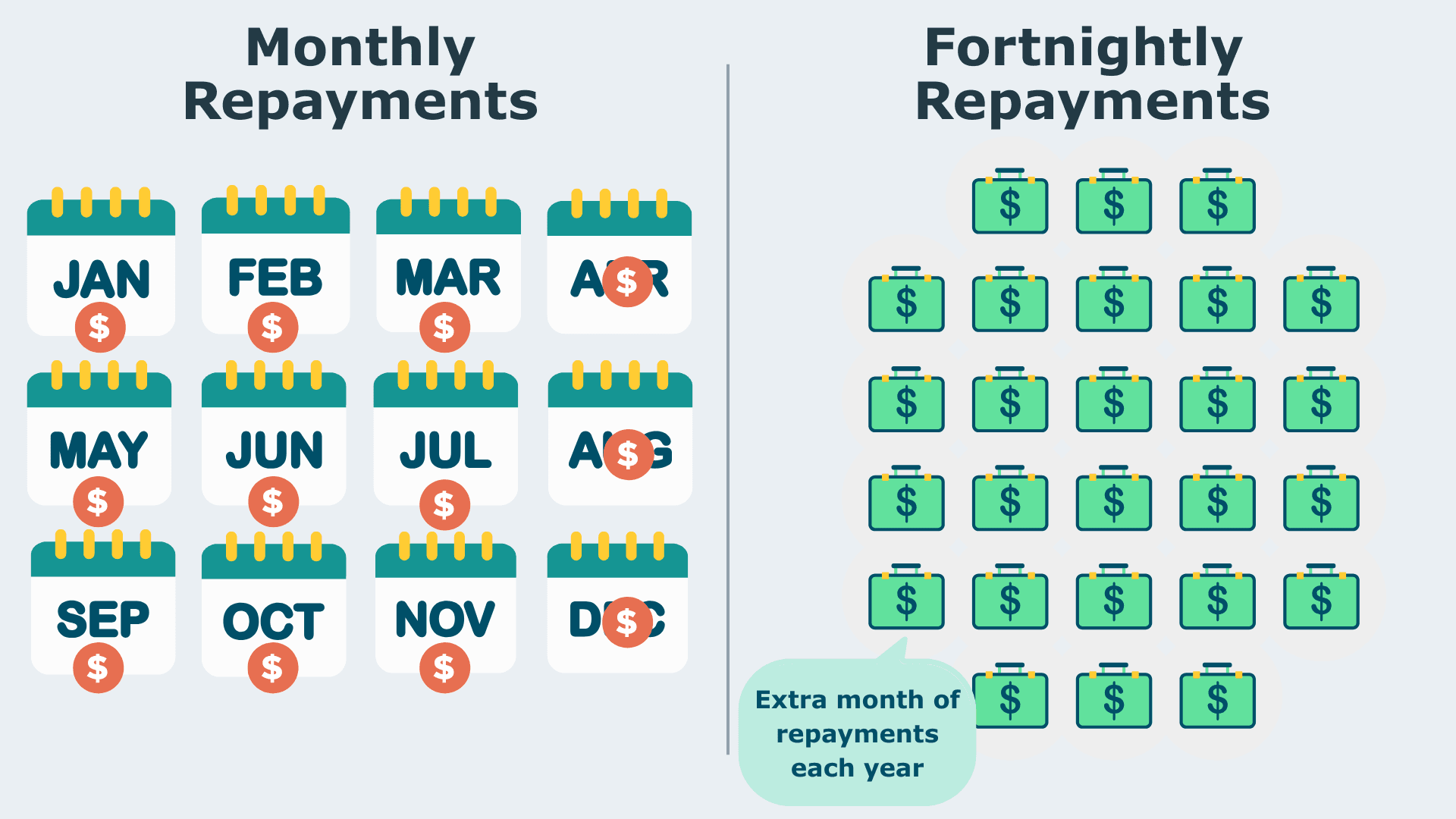

- Switching from monthly to fortnightly, while keeping the same total yearly amount, can effectively add one extra monthly repayment each year.

- Online calculators make it easy to test how different repayment frequencies and extra payments change the time and interest on your loan.

- Fortnightly repayments suit many households, but you still need a buffer for bills, rate changes and other debts.

- There is no single best way to pay off mortgage faster, but small, consistent steps can cut years off your home loan.

How fortnightly repayments save you money

If you have a variable rate home loan, you have probably heard the promise that paying fortnightly helps you pay off mortgage faster. The idea is simple. Instead of one monthly repayment, you halve that amount and pay the half every fortnight. On the surface it feels the same, yet over time it quietly gets you ahead.

The key is in the calendar. There are 12 months in a year, but 26 fortnights. When you halve your monthly repayment and pay that smaller amount every two weeks, you end up making the equivalent of 13 full monthly repayments each year, not 12. You are effectively sneaking in one extra repayment without having to think about it. Because interest on most Australian home loans is calculated daily, those small extra amounts reduce your balance sooner, so less interest builds up.

Let us look at a simple example. Imagine a $600,000 home loan over 30 years at an interest rate close to 6.88 percent. A rough monthly repayment might land around the mid $3,000s. If you pay that monthly, you make 12 of those repayments each year. If instead you pay half that amount every fortnight, you make 26 half repayments in a year. That works out to the same monthly figure plus another full month on top. Over a 30 year term, that extra month every year can trim years off the loan and could save well over $200,000 in interest, based on worked examples that assume you keep making the higher fortnightly payments even if the bank reduces the minimum later.

This sounds almost like a magic trick, but it is not free money. You are paying more across each year, just in smaller, more frequent steps. That means you need to be confident your budget can handle the cash flow. The good news is that many Australians find it easier to line up fortnightly repayments with their pay cycle. If you are paid every two weeks, treating your mortgage repayment like a regular bill that goes out on payday can reduce stress and keep you on track.

Checklist: switching to fortnightly repayments

- Confirm with your lender that fortnightly repayments are allowed and whether there are any fees or limits.

- Work out your current minimum monthly repayment, then halve it for your fortnightly target.

- Set up an automatic transfer or direct debit every fortnight on or just after payday.

- Review your budget so regular bills and savings still fit comfortably around the new schedule.

What this means for Buyers

- When planning a purchase, model your loan as fortnightly from day one so the higher yearly total does not catch you by surprise.

- Use fortnightly figures when talking to your bank or mortgage broker so the numbers match how you are actually going to pay mortgage costs.

- Factor in the extra month of repayments each year when comparing properties so you do not stretch your budget too far.

What this means for Current borrowers

- If your income arrives fortnightly, matching your repayments to your pay cycle can make money management feel smoother.

- Switching to fortnightly without lowering the yearly total can chip away at your balance and act like a built in extra repayment plan.

- If you are already paying more than the minimum, check whether a structured fortnightly schedule could build an even bigger buffer.

Related reading: Paying off your home loan sooner

- 5 Strategies to Pay Off Your Home Loan Faster

- How to Pay Off your Loan Sooner: Slash Years Off Your Loan

- Extra Loan Repayments: Strategy to Pay Off Mortgage Fast

Quick Q&A

Q: Do fortnightly repayments always save money? A: Fortnightly repayments help when you keep the yearly total higher than the minimum, which happens when you halve the monthly amount and pay it every fortnight. If your lender simply divides the minimum yearly total into 26 equal parts, you will not get the extra benefit.

Q: Is it better to switch to fortnightly or just increase my monthly repayment? A: Mathematically, both approaches help in similar ways if the total extra you pay each year is the same. The real question is which structure makes it easier for you to stay disciplined. Many people like fortnightly because it lines up with their pay and feels more manageable.

Using calculators to plan your payoff

Before changing how often you pay, it helps to see the numbers on screen. This is where a simple online tool comes in. A good loan calculator home loan tool lets you compare monthly versus fortnightly repayments and add small extra amounts to see how much faster the loan finishes. When you can see the "before and after" side by side, it is easier to choose a plan you will actually stick with.

When you search online, you will find all kinds of tools with slightly different labels. Some sites offer a "pay off mortgage calculator" or a "pay off mortgage faster calculator". Others talk about a "pay off mortgage early calculator" or a "pay home loan faster calculator". You might also see a "paying off home loan early calculator", a "mortgage calculator to pay off early", "pay mortgage faster calculator", "pay off loan faster calculator", "home loan rate calculator" or even a very basic "calculator mortgage" page. The names differ, but the idea is the same. These tools show how changing your repayment amount or timing can help you pay off your mortgage faster.

A good way to start is to plug in a simple Australian example that looks a bit like your situation. Say you are buying a $500,000 home with a 5 percent deposit, so you borrow $475,000. You could test one scenario where you pay monthly at the minimum, then another where you pay fortnightly and add an extra $50 per repayment. You will usually see two big differences. First, the loan finishes years earlier. Second, the total interest paid across the life of the loan drops by tens of thousands of dollars. That is the power of acting early and letting time do the heavy lifting for you.

Some tools also let you adjust interest rates. This is useful if you want to compare how rising or falling rates affect your plan. You can look at a version of your loan today, then another version where rates are 1 percent higher, and see if your budget still copes. This helps you avoid over committing and lets you test ways to build a buffer now so future rate rises feel less scary.

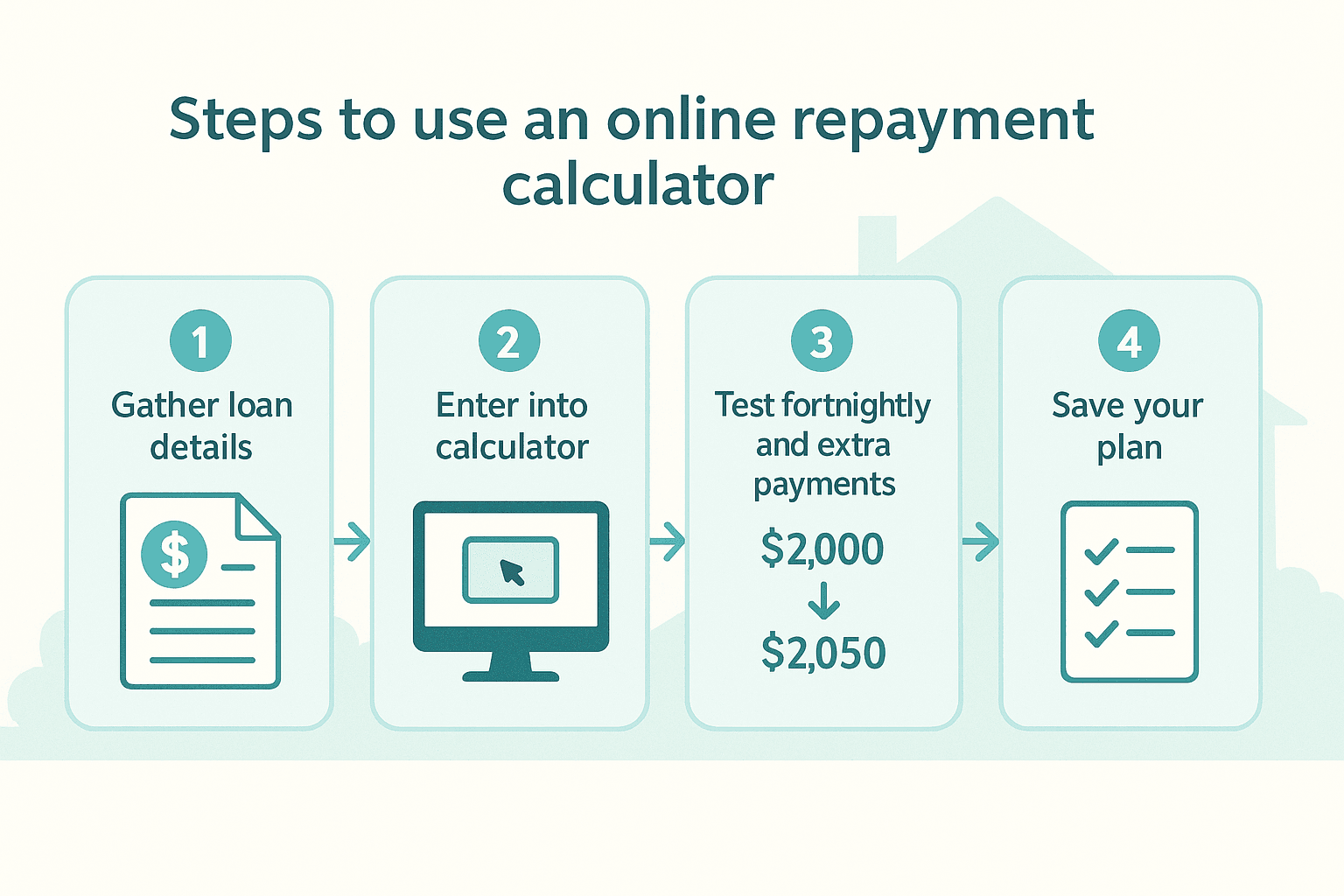

Steps to use an online repayment calculator

- Gather your basic details: loan amount, interest rate, loan term and current repayment frequency.

- Enter these into a mortgage calculator payments style tool and confirm the results match your current repayment.

- Switch the setting to fortnightly and test a slightly higher repayment to see how the time and total interest change.

- Save or screenshot the scenario that feels realistic so you can turn it into an actual repayment plan with your lender.

Related reading: Smart calculators and home loan tools

What this means for Buyers

- Using a pay off home loan faster calculator before you buy can show you the long term impact of stretching for a more expensive property.

- Running a few "what if" scenarios can help you choose a price range and repayment plan that fits both your goals and your lifestyle.

- Seeing the difference a small extra repayment makes early on can be a strong motivator to keep your spending in check.

What this means for Current borrowers

- If you already have a loan, a paying down mortgage check with an online tool can highlight how close you are to key milestones, like 80 percent loan to value.

- Regularly reviewing your numbers can help you spot new ways to pay off mortgage early when your income rises or other debts fall away.

- If the numbers feel overwhelming, you can bring your calculator results to a trusted mortgage broker and ask them to walk through options with you.

Quick Q&A

Q: Do I need a special "pay off mortgage faster calculator" to plan this? A: No. Any solid home loan calculator that lets you change repayment amounts and frequency will work. The labels are less important than the features. Focus on tools that clearly show time saved and total interest saved.

Q: How often should I revisit my calculator plan? A: A quick check once or twice a year is usually enough, or whenever your income, expenses or interest rate changes. That way you can adjust your plan instead of drifting back to the minimum repayment without noticing.

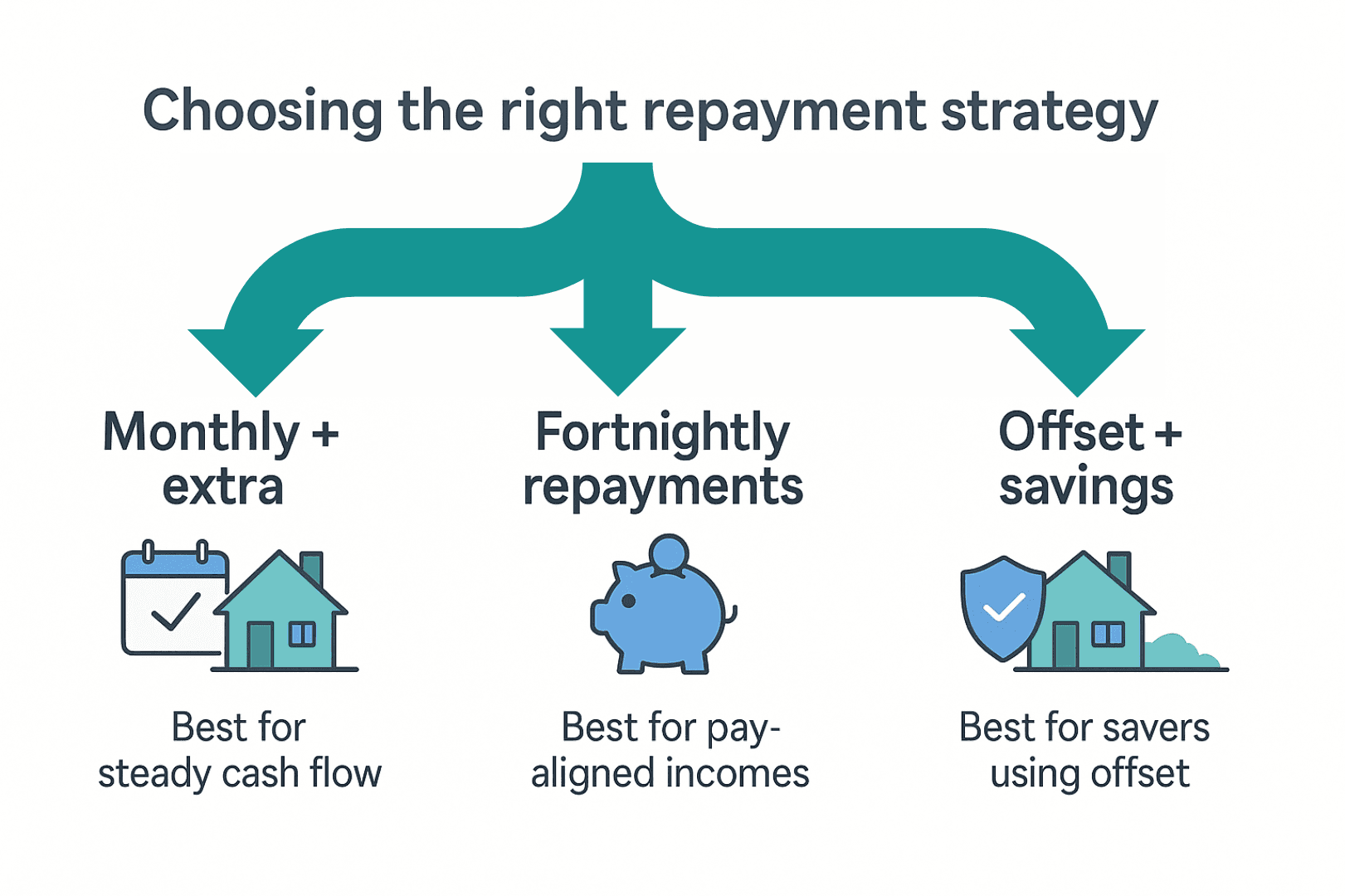

>Choosing the right repayment strategy

Fortnightly repayments are powerful, but they are not the only option. Some people prefer to stick with monthly repayments and simply add a little extra each time. Others aim to throw in lump sums when they receive a bonus or tax refund. The best way to pay off mortgage faster is usually the one that lines up with your personality, cash flow and other goals, not a perfect formula.

You also need to look at the whole picture, not just your home loan. If you have high interest credit card debt or personal loans, it might make sense to clear those first before pushing harder on the mortgage. The interest on those debts is usually far higher than your home loan. Once they are gone, you can redirect those repayments to your mortgage and accelerate your progress without increasing your overall outgoings.

Another piece of the puzzle is how you use your banking features. An offset account is a normal everyday or savings account that is linked to your home loan so the balance in the account reduces the amount of your loan that is charged interest. For example, if your home loan balance is $500,000 and you keep $20,000 in an offset, you are only charged interest as if you owed $480,000. If you are using an offset account heavily, you may prefer to keep your loan repayments monthly and simply keep more cash sitting in the offset rather than changing frequency.

Finally, think about how long you plan to keep this loan. Many Australians refinance, move home or restructure their lending every five to seven years. That means you do not have to lock in one strategy for 30 years. You might start with fortnightly repayments to build a buffer, then later focus on extra lump sums or using an offset to prepare for your next move. The important thing is to be deliberate rather than letting the bank's default setting decide for you.

Checklist: before changing your repayment strategy

- List your other debts and interest rates so you know where extra money will have the biggest impact.

- Decide whether you prefer structure (like automatic fortnightly repayments) or flexibility (like extra lump sums when cash is available).

- Review how your offset or redraw features currently work so you do not accidentally reduce their benefits.

- Ask your lender what happens if you change from monthly to fortnightly or back again so there are no surprises.

What this means for Buyers

- When choosing a loan, look beyond the headline rate and think about how you actually want to make repayments.

- If you value flexibility, a loan with low or no fees for extra repayments or changes in frequency might be worth a slightly higher rate.

- Building a clear plan for how you will handle rate rises and life changes can make your first few years as a homeowner much less stressful.

What this means for Current borrowers

- If you are already ahead on your loan, you may be able to reduce your minimum repayment while still keeping a strong buffer in place.

- After each rate cut, consider keeping your repayments at the old level so that more of each payment goes to the loan rather than your wallet.

- If making fortnightly repayments is creating cash flow pressure, it is okay to scale back for a while and focus on stability instead of speed.

Quick Q&A

Q: Is there one best way to pay off mortgage for everyone? A: No. Some people like the rhythm of fortnightly repayments. Others prefer simple monthly payments plus occasional lump sums. The right strategy is the one you can stick to comfortably over many years.

Q: Should I change my repayment plan every time the cash rate moves? A: Not necessarily. It is helpful to review your plan when rates change, but constant tweaks can be exhausting. A better approach is to check in once or twice a year and make a simple adjustment if you are falling behind your goals.

Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.

Written By

The Craggle Team