Home Of Fair Facts & Tips

Buying Property With Your SMSF

Learn how SMSF property investing works in Australia, from key rules and loan risks to simple steps to get your fund ready to buy.

Thinking about buying property with super but not sure where to start? This guide explains how SMSF property works, the key rules you must follow, and how borrowing inside your fund is different to a regular home loan. You will see simple examples using a $500,000 to $600,000 purchase, understand the extra costs and risks, and walk through clear steps to get your fund “property ready”.

By the end, you will know the right questions to ask your accountant, adviser and lender before you make a move.

Buying Property With Your SMSF

Key takeaways

- SMSF property must pass strict rules and can only be used to build retirement savings, not personal lifestyle perks.

- SMSF loans often need bigger deposits and stricter conditions than standard investment loans, so cash flow planning is critical.

- There are clear steps to check your fund rules, strategy, costs and borrowing capacity before you look at any property.

- Good records, independent advice and careful lender selection can help your superannuation property investment stay on the right side of the ATO.

SMSF property basics and rules

A self managed super fund is a private super fund that you run yourself, rather than through a big retail or industry fund. You decide how the money is invested, within strict rules set by the Australian Taxation Office. Many people like the idea of self managed super fund property because it mixes retirement savings with an asset they can see and understand. In recent years, thousands of SMSFs have been set up across Australia, and property is a common goal for new trustees.

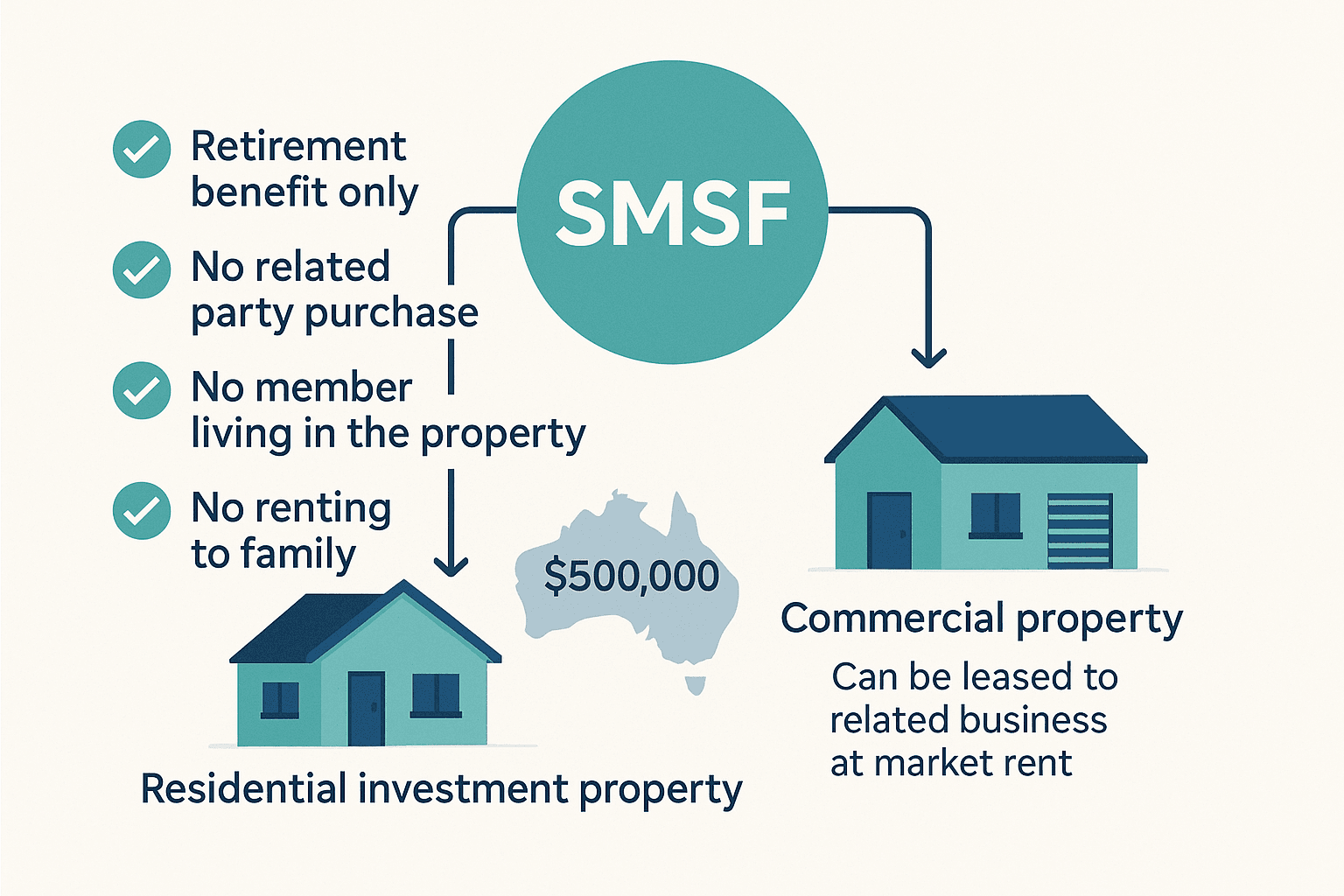

When people talk about SMSF property, they usually mean buying an investment property inside the fund, not a home to live in. To pass the “sole purpose test”, the property must be held only to provide retirement benefits to members. That means the property cannot be bought from a related party, cannot be lived in by members or their relatives, and generally cannot be rented to related parties if it is residential. Commercial property is different: an SMSF can often buy a business premises and lease it to a related business if the lease is on normal commercial terms and at market rent.

This is why buying property with super is about long term investing, not personal use or quick tax tricks. A typical example might be a fund with $600,000 in total assets that wants to hold one SMSF investment property worth $500,000. The trustees must still keep a sensible spread of investments, think about diversification, and leave enough liquid assets like cash and listed investments to pay fees and any pensions. On top of that, in house assets such as certain loans to related parties are capped at 5 percent of total fund value, so trustees cannot load the fund with related party deals.

There are real costs involved. On top of the purchase price, the fund may pay stamp duty, legal fees, building and pest reports, bank and SMSF finance fees, ongoing property management, insurance, accounting and audit fees. These can add up quickly and reduce the amount left in super for retirement. This is why consumer guidance from Australian regulators stresses the need to understand all the costs, risks and conflicts of interest before using self managed super for direct property.

For some trustees, using superannuation property can still make sense. For example, two members in their 40s might use their self managed super fund to buy a $500,000 commercial unit in a regional city and lease it to their own business at market rent. The rent and ongoing contributions can help build long term retirement savings. Another fund might target residential property in a growth corridor, as long as the property is purely an arm’s length investment with no personal use or related party tenant.

Checklist: Is SMSF property right for you?

- Confirm your trust deed and investment strategy allow direct property and clearly state why the asset suits your long term retirement plan.

- Check whether buying property with super will leave enough cash and diversified assets for fees, pensions and unexpected events.

- Estimate rent and compare it with ongoing costs such as rates, insurance, maintenance, SMSF admin and audit fees.

- Ask your accountant or adviser to explain the tax and compliance impacts in plain English before you move ahead.

What this means for Buyers

- If you want to use your SMSF to buy property, accept that you cannot live in it, holiday in it or rent it to family.

- Residential SMSF investment property must be a genuine arm’s length investment, with normal tenants and market level rent.

- Commercial property can sometimes be leased to your own business, but only on proper commercial terms with written leases and regular reviews.

Quick Q&A

Q: Can I use my SMSF when I am using super to buy a house I want to live in one day?

A: No. The fund cannot buy a home for you or your relatives to live in, even if the plan is to move in at retirement. The property must stay a pure investment while it sits inside the SMSF.

Q: Is using super to buy property from myself or my family allowed?

A: For residential property, your SMSF cannot buy a place from you, your relatives or other related parties. Certain business premises can be sold to the fund if they meet commercial rules, but this needs careful advice.

Borrowing with your SMSF for property

Many trustees explore an SMSF home loan so the fund can afford a more expensive property. Borrowing inside an SMSF usually happens through a structure called a limited recourse borrowing arrangement. In simple terms, the lender’s main security is the property held in a separate holding trust, not the other assets of the fund. If repayments cannot be made, the lender can take that property but cannot chase the rest of the fund’s investments.

An SMSF property loan looks similar to an investment loan from the outside, but there are extra rules. The borrowed money can generally only be used to buy a single asset, like one residential or commercial property, and to pay for certain repairs or maintenance. It cannot be used to build a completely new dwelling on vacant land or to substantially change the character of the property. This is why SMSF lending is often more complex than standard investment lending and why only some lenders choose to offer these products.

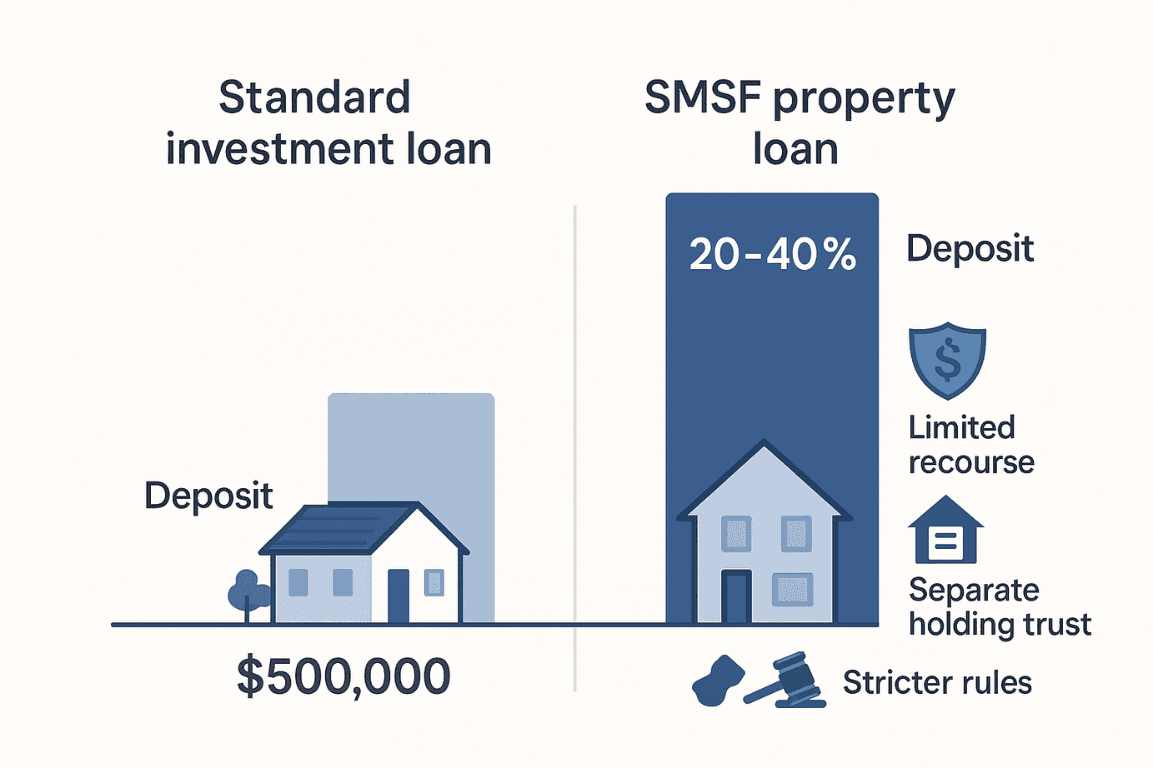

Deposit sizes are usually larger as well. While every lender is different, many SMSF loans Australia wide ask for 20 to 40 percent of the purchase price as a deposit, plus extra cash in the fund for liquidity. For example, if your SMSF wants to buy a $500,000 residential property as part of an SMSF investment property loan, a 30 percent deposit would be $150,000. Add another $30,000 to $40,000 for stamp duty, legal fees and other upfront costs and your fund may need close to $190,000 in cash before settlement.

SMSF loans often have higher interest rates and tighter lending criteria than standard investment loans. Lenders will look closely at expected rent, member contributions, existing self managed super fund loans and the overall risk of the fund. If interest rates rise or the property sits vacant, the SMSF must still meet repayments. You usually cannot use losses from an SMSF investment property to reduce your personal taxable income outside the fund, which makes cash flow planning even more important.

All of this makes careful planning essential if you are comparing SMSF home loans Australia products. A fund with $400,000 in assets might be able to borrow $350,000 to buy a $500,000 property through an SMSF finance facility, but only if rent and contributions comfortably cover repayments and running costs. Trustees also need to think ahead about events such as illness, disability or death of a member, and how the fund will manage pensions or lump sum benefits while an SMSF mortgage is still in place.

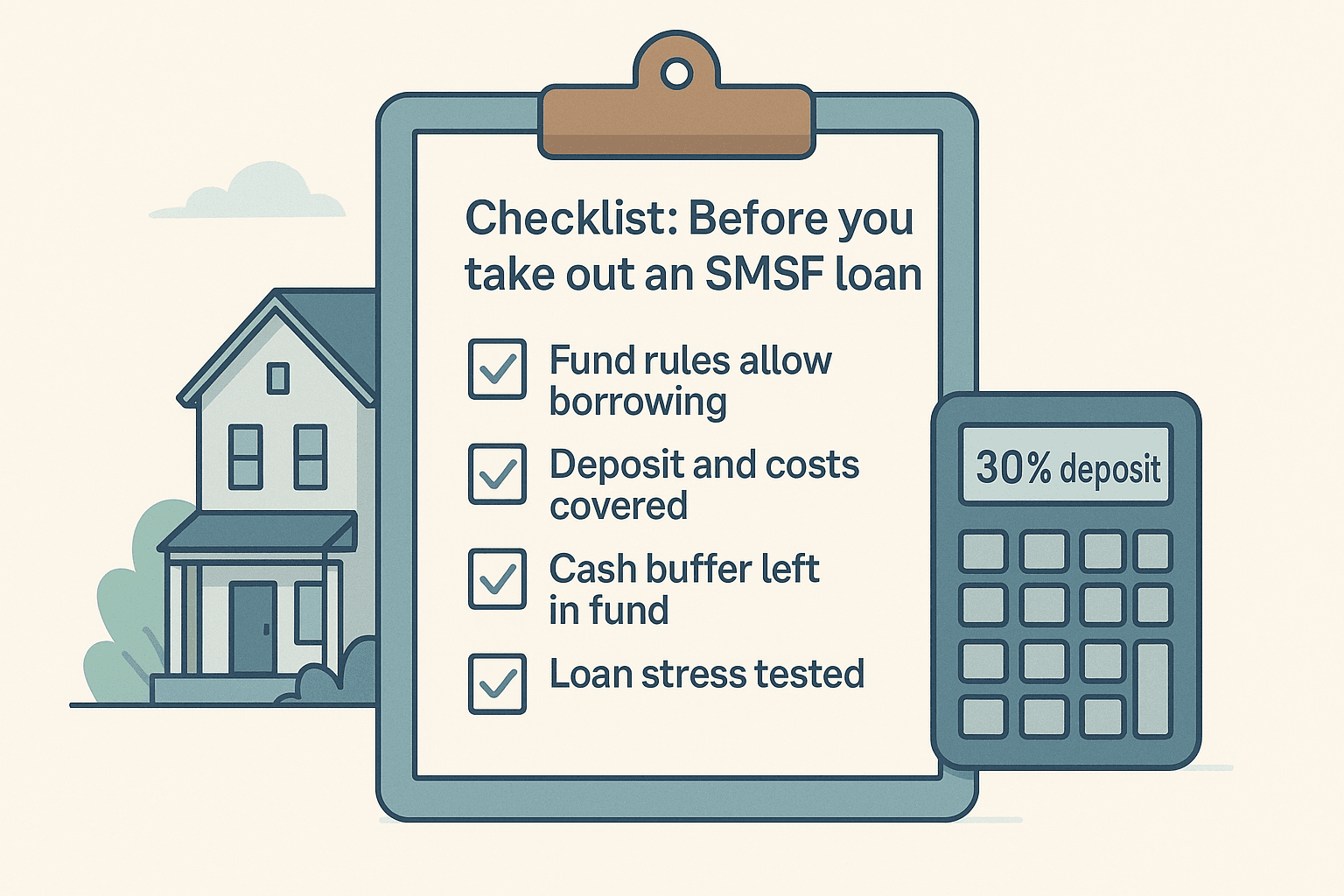

Checklist: Before you take out an SMSF loan

- Confirm your trust deed and investment strategy allow borrowing and explain why the property fits the long term SMSF plan.

- Work out your total deposit, stamp duty and setup costs, then check how much cash will stay in the fund after settlement.

- Stress test repayments using higher interest rates and lower rent so you can see how the fund would cope if things go wrong.

- Discuss SMSF lending options with a licensed adviser and, if useful, an experienced SMSF mortgage broker who understands the rules.

Related reading: Understanding purchase costs

- Calculate Your Stamp Duty

- Stamp Duty Explained: A Property Buyer's Roadmap

- Reduce Tax with Negative Gearing: Investment Property Guide

What this means for Buyers

- You will probably need a bigger deposit and more paperwork than with a standard investment loan, so give yourself extra time.

- The cheapest rate is not always the best choice if the lender has limited experience with SMSF structures and SMSF property loan requirements.

- Focus on whether the loan works for your fund’s cash flow and retirement timing, not just on chasing the best SMSF loans headline rate.

What this means for Current borrowers

- If you already have a self managed super fund mortgage, review it regularly to check the property is still a good fit for your fund.

- Confirm that contributions and rent are still enough to cover repayments, especially after interest rate rises or rental vacancies.

- Consider whether refinancing a self managed super fund home loan makes sense, but weigh the costs, restrictions and any lost features.

Quick Q&A

Q: How much deposit do I usually need for an SMSF investment property purchase?

A: Many lenders ask for at least 20 to 30 percent of the purchase price as a deposit, and some may want more. You also need extra cash in the fund for upfront costs and a safety buffer for repairs and vacancies.

Q: Can I treat an SMSF loan like a normal investment loan and just choose the cheapest interest rate?

A: You can compare rates and fees, but you also need to look at which lenders support limited recourse borrowing structures, have clear rules for SMSF home loan products and are willing to work closely with your accountant and adviser.

Steps to get SMSF property ready

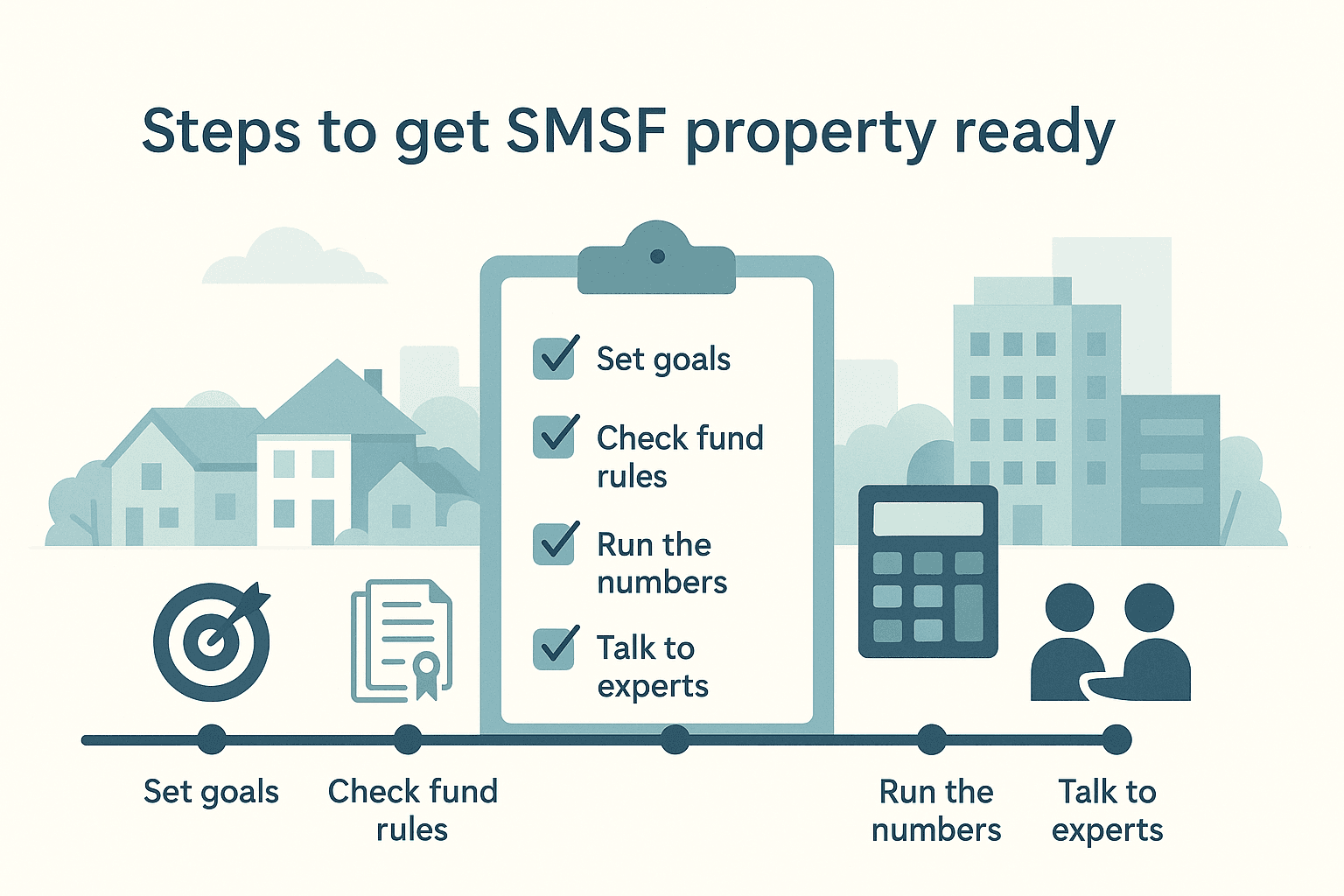

Before you look at any real estate listing, it helps to map out a clear path for your fund. Start with your goals: what do you want your self managed super fund to achieve, when do you plan to retire, and how comfortable are you with property risk compared with other assets? Direct property inside super is a chunky, long term investment. It can work well for some funds and be unsuitable for others, even if both are keen to use super to buy investment property.

The next step is to review your documents. Check that your trust deed allows direct property and borrowing, and that your written investment strategy explains why using super to buy property fits your plan. This is where your accountant, SMSF administrator and adviser can help shape the strategy. Together, you can decide whether an SMSF investment property, a more diversified share portfolio, or a mix of both is the better fit for your stage of life.

Then it is time to crunch some simple numbers. Imagine you want to buy investment property with super by targeting a $600,000 residential property in a capital city. A 30 percent deposit would be $180,000. If upfront purchase costs come to another $40,000, your fund needs at least $220,000 in cash. On top of that, you might aim to keep 10 to 20 percent of the fund’s assets in liquid investments after the purchase so you can pay fees and future pensions without stress.

Once you have a rough budget, you can start to engage lenders and advisers about specific SMSF loans products. At this stage, it is tempting to focus only on interest rates, but long term service and clear communication matter just as much. Some trustees will seek out what they see as the best SMSF loans, while others care more about working with a small panel of specialists who know their fund well. Online tools and calculators can help you see how a self managed super fund home loan compares with investing the same money in other assets.

Finally, think about long term management. Who will handle insurance renewals, repairs and lease negotiations? What happens if a member leaves the fund, or if you move into pension phase and need more regular income? Building these scenarios into your plan now makes it easier to run the property smoothly later. The goal is usually a well managed asset that quietly supports retirement income, not a second job dealing with constant property headaches.

Step by step: Getting SMSF property ready

- Clarify your retirement goals, risk comfort and time frame for holding property in your SMSF.

- Ask your accountant to check the trust deed and investment strategy for any changes needed before you buy.

- Estimate your target purchase price, deposit, setup costs and the minimum cash buffer you want to keep in the fund.

- Speak with an adviser and, if useful, an SMSF mortgage broker to outline borrowing options and next steps.

What this means for Buyers

- You can move at your own pace, starting with a simple goals chat before you look at any property or SMSF investment property loan options.

- A clear written plan makes it easier to say no to property spruikers or offers that do not match your strategy.

- Using calculators and professional advice up front can save you from costly mistakes if using super to buy a house or unit turns out not to be the right fit.

Quick Q&A

Q: Do I need a very large balance before my SMSF can buy property?

A: There is no fixed minimum in the law, but because of higher deposits and running costs, smaller funds can become too concentrated in one asset. Many trustees wait until the fund can buy comfortably and still keep a healthy cash buffer.

Q: How do I actually get started if I want an SMSF investment property strategy?

A: Start with your existing advisers. Ask them to walk you through the steps, test scenarios such as using super to buy property, and explain whether a self managed super fund property plan suits your age, balance and risk comfort.

Related reading: Building your investor toolkit

Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations.Written By

The Craggle Team